Banking software provider Q2 (NYSE: QTWO) reported Q1 CY2025 results exceeding the market’s revenue expectations, with sales up 14.6% year on year to $189.7 million. Guidance for next quarter’s revenue was better than expected at $193 million at the midpoint, 0.8% above analysts’ estimates. Its GAAP profit of $0.07 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Q2 Holdings? Find out by accessing our full research report, it’s free.

Q2 Holdings (QTWO) Q1 CY2025 Highlights:

- Revenue: $189.7 million vs analyst estimates of $186.6 million (14.6% year-on-year growth, 1.7% beat)

- EPS (GAAP): $0.07 vs analyst estimates of -$0.01 (significant beat)

- Adjusted Operating Income: $32.7 million vs analyst estimates of $29.96 million (17.2% margin, 9.1% beat)

- The company slightly lifted its revenue guidance for the full year to $779.5 million at the midpoint from $775.5 million

- EBITDA guidance for the full year is $172.5 million at the midpoint, above analyst estimates of $168.1 million

- Operating Margin: 1.2%, up from -8.6% in the same quarter last year

- Free Cash Flow Margin: 19.9%, similar to the previous quarter

- Market Capitalization: $4.94 billion

Company Overview

Founded in 2004 by Hank Seale, Q2 (NYSE: QTWO) offers software-as-a-service that enables small banks to provide online banking and consumer lending services to their clients.

Sales Growth

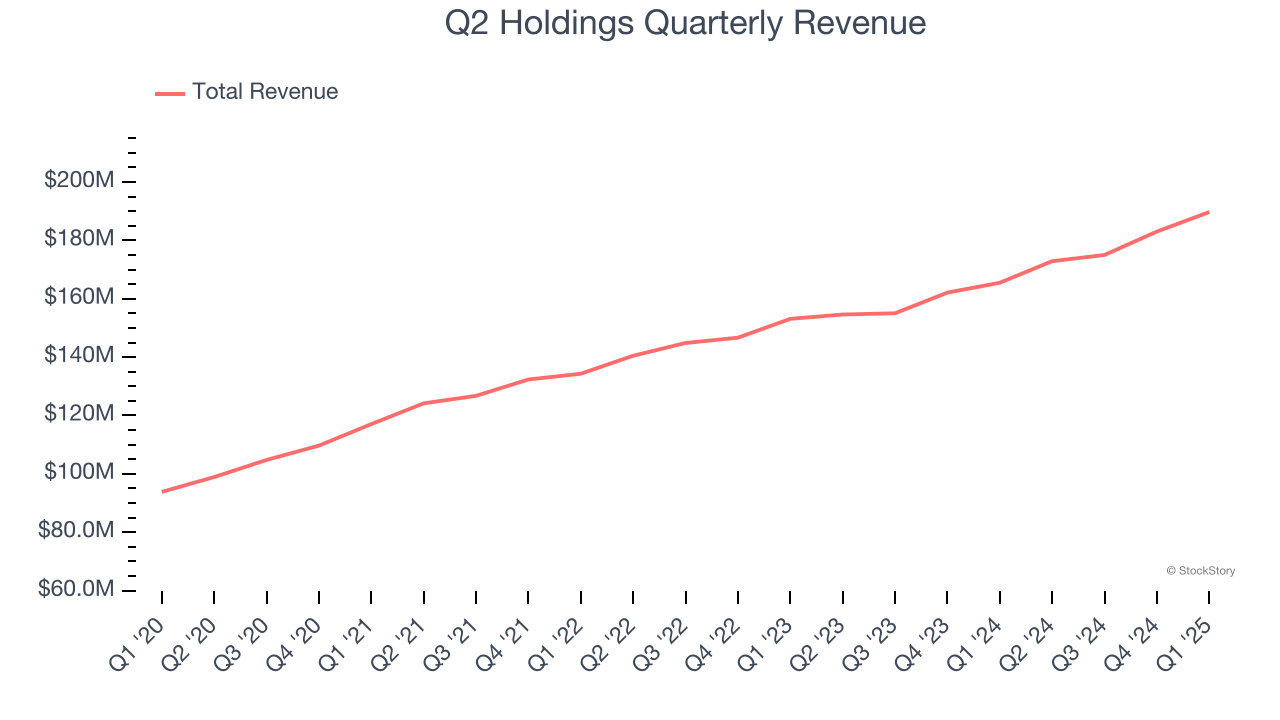

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last three years, Q2 Holdings grew its sales at a 11.7% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds.

This quarter, Q2 Holdings reported year-on-year revenue growth of 14.6%, and its $189.7 million of revenue exceeded Wall Street’s estimates by 1.7%. Company management is currently guiding for a 11.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 10.4% over the next 12 months, similar to its three-year rate. Despite the slowdown, this projection is above the sector average and implies the market is forecasting some success for its newer products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Q2 Holdings is quite efficient at acquiring new customers, and its CAC payback period checked in at 34.6 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

Key Takeaways from Q2 Holdings’s Q1 Results

We enjoyed seeing Q2 Holdings beat analysts’ EBITDA expectations this quarter. We were also glad its full-year EBITDA guidance exceeded Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 8% to $86.78 immediately after reporting.

Q2 Holdings may have had a good quarter, but does that mean you should invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.