The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how vertical software stocks fared in Q1, starting with nCino (NASDAQ: NCNO).

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

The 14 vertical software stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 2.8% while next quarter’s revenue guidance was in line.

Luckily, vertical software stocks have performed well with share prices up 17.4% on average since the latest earnings results.

nCino (NASDAQ: NCNO)

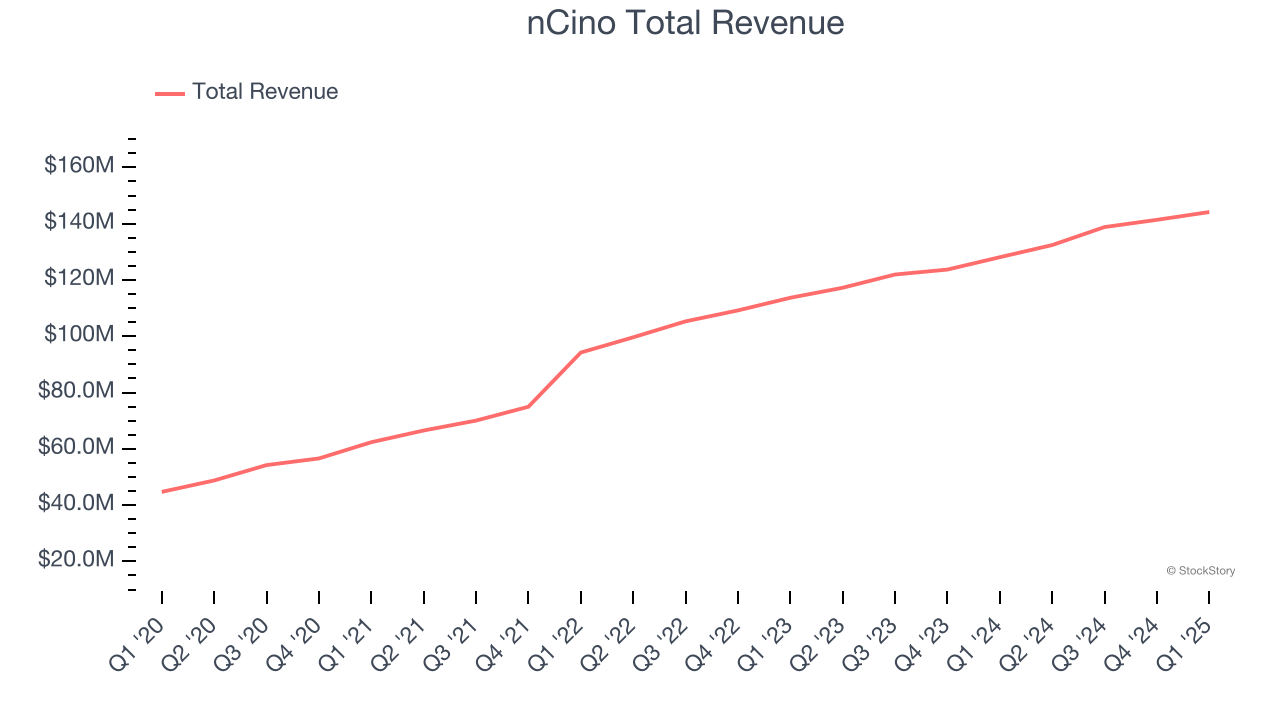

Founded in 2011 in North Carolina, nCino (NASDAQ: NCNO) makes cloud-based operating systems for banks and provides that software-as-a-service.

nCino reported revenues of $144.1 million, up 12.5% year on year. This print exceeded analysts’ expectations by 2.7%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ billings estimates.

"Strong execution drove financial results above guidance, underscoring our ability to deliver value for shareholders and customers," said Sean Desmond, CEO at nCino.

Interestingly, the stock is up 10.1% since reporting and currently trades at $29.48.

Is now the time to buy nCino? Access our full analysis of the earnings results here, it’s free.

Best Q1: Veeva Systems (NYSE: VEEV)

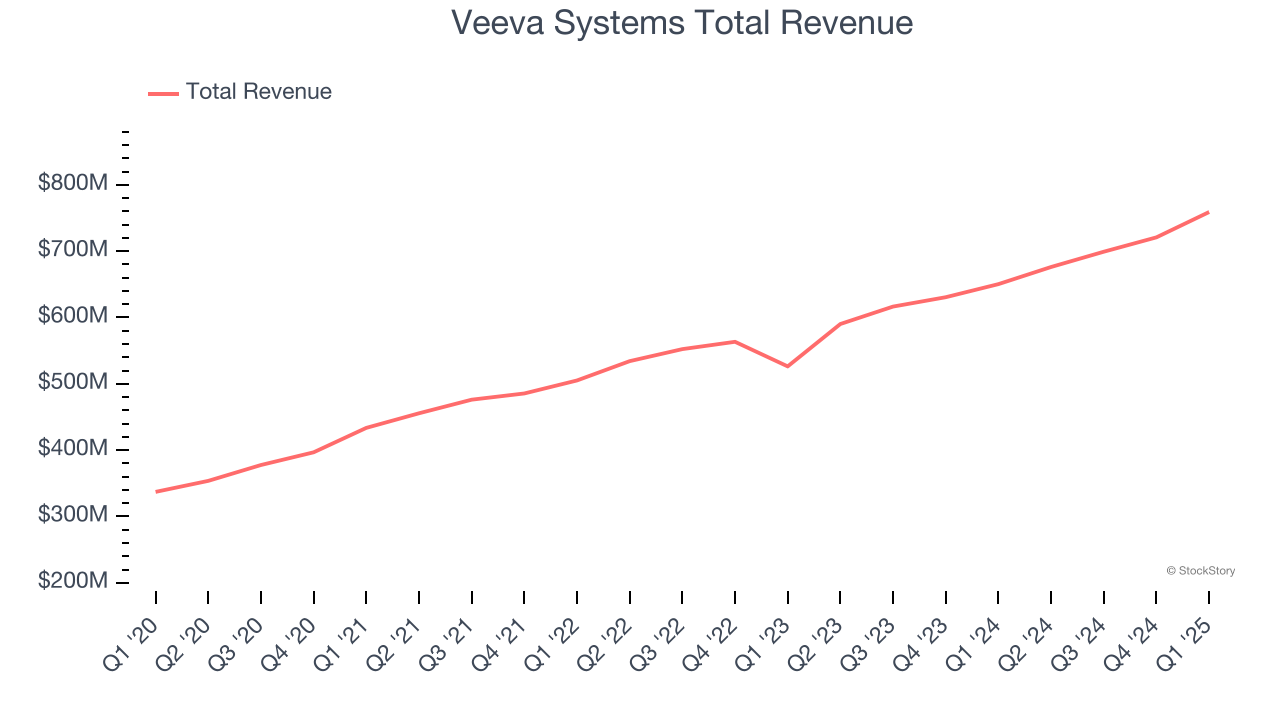

Built on top of Salesforce as one of the first vertical-focused cloud platforms, Veeva (NYSE: VEEV) provides data and customer relationship management (CRM) software for organizations in the life sciences industry.

Veeva Systems reported revenues of $759 million, up 16.7% year on year, outperforming analysts’ expectations by 4.2%. The business had an exceptional quarter with an impressive beat of analysts’ billings estimates and EPS guidance for next quarter exceeding analysts’ expectations.

Veeva Systems achieved the highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 18.6% since reporting. It currently trades at $278.75.

Is now the time to buy Veeva Systems? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Doximity (NYSE: DOCS)

Founded in 2010 and named for a combination of “docs” and “proximity”, Doximity (NYSE: DOCS) is the leading social network for U.S. medical professionals.

Doximity reported revenues of $138.3 million, up 17.1% year on year, exceeding analysts’ expectations by 3.5%. Still, it was a slower quarter as it posted full-year guidance of slowing revenue growth and EBITDA guidance for next quarter missing analysts’ expectations significantly.

Interestingly, the stock is up 5.4% since the results and currently trades at $61.60.

Read our full analysis of Doximity’s results here.

PTC (NASDAQ: PTC)

Used to design the Airbus A380 and Boeing 787 Dreamliner commercial airplanes, PTC’s (NASDAQ: PTC) software-as-service platform helps engineers and designers create and test products before manufacturing.

PTC reported revenues of $636.4 million, up 5.5% year on year. This print surpassed analysts’ expectations by 5%. Aside from that, it was a mixed quarter as it also recorded a solid beat of analysts’ EBITDA estimates but EPS guidance for next quarter missing analysts’ expectations significantly.

The stock is up 24.4% since reporting and currently trades at $192.55.

Read our full, actionable report on PTC here, it’s free.

Procore (NYSE: PCOR)

Used to manage the multi-year expansion of the Panama Canal that began in 2007, Procore (NYSE: PCOR) offers a software-as-service project, finance, and quality management platform for the construction industry.

Procore reported revenues of $310.6 million, up 15.3% year on year. This result topped analysts’ expectations by 2.6%. Overall, it was a strong quarter as it also recorded accelerating customer growth and an impressive beat of analysts’ EBITDA estimates.

The company added 218 customers to reach a total of 17,306. The stock is up 12.2% since reporting and currently trades at $70.90.

Read our full, actionable report on Procore here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.