Looking back on cybersecurity stocks’ Q1 earnings, we examine this quarter’s best and worst performers, including Tenable (NASDAQ: TENB) and its peers.

Cybersecurity continues to be one of the fastest-growing segments within software for good reason. Almost every company is slowly finding itself becoming a technology company and facing rising cybersecurity risks. Businesses are accelerating adoption of cloud-based software, moving data and applications into the cloud to save costs while improving performance. This migration has opened them to a multitude of new threats, like employees accessing data via their smartphone while on an open network, or logging into a web-based interface from a laptop in a new location.

The 9 cybersecurity stocks we track reported a satisfactory Q1. As a group, revenues beat analysts’ consensus estimates by 1.2% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Tenable (NASDAQ: TENB)

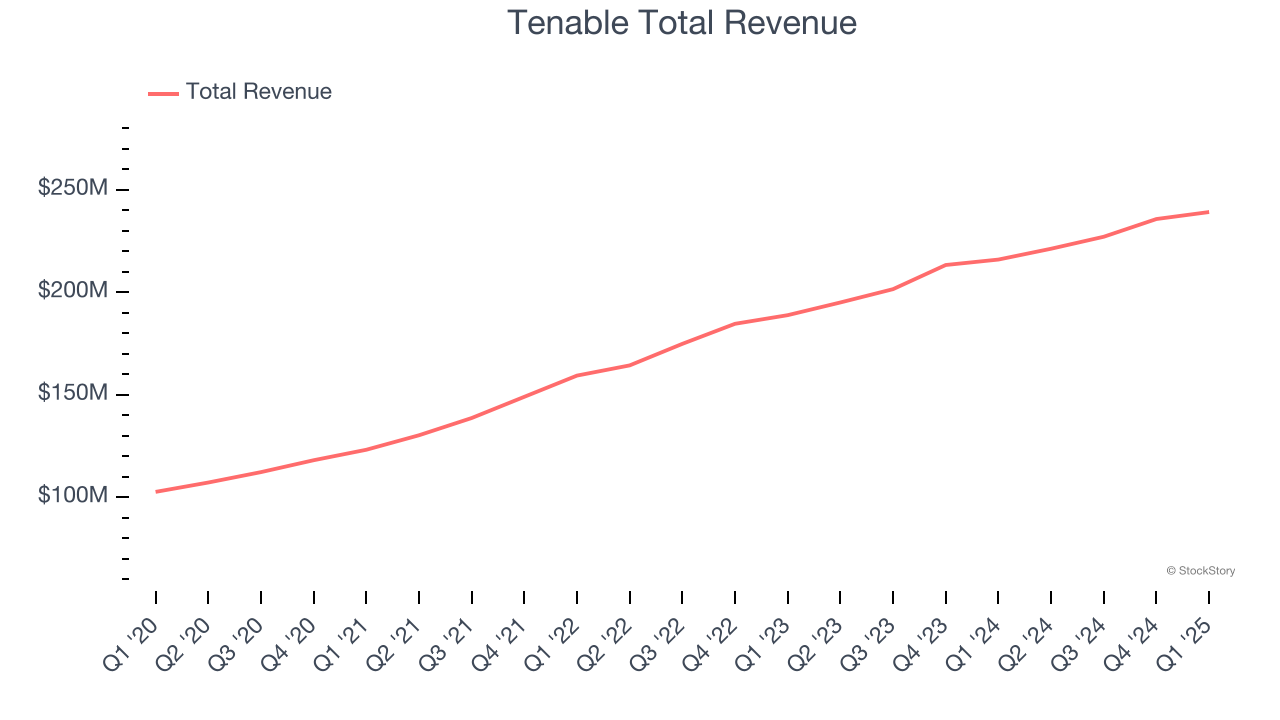

Founded in 2002 by three cybersecurity veterans, Tenable (NASDAQ: TENB) provides software as a service that helps companies understand where they are exposed to cyber security risk and how to reduce it.

Tenable reported revenues of $239.1 million, up 10.7% year on year. This print exceeded analysts’ expectations by 2.4%. Overall, it was a satisfactory quarter for the company with an impressive beat of analysts’ EBITDA estimates but a significant miss of analysts’ annual recurring revenue estimates.

"We had a strong start to the year with better-than-expected results on both the top and bottom line," said Steve Vintz, Co-CEO of Tenable.

Tenable achieved the biggest analyst estimates beat of the whole group. The results were likely priced in, however, and the stock is flat since reporting. It currently trades at $33.47.

Is now the time to buy Tenable? Access our full analysis of the earnings results here, it’s free.

Best Q1: Zscaler (NASDAQ: ZS)

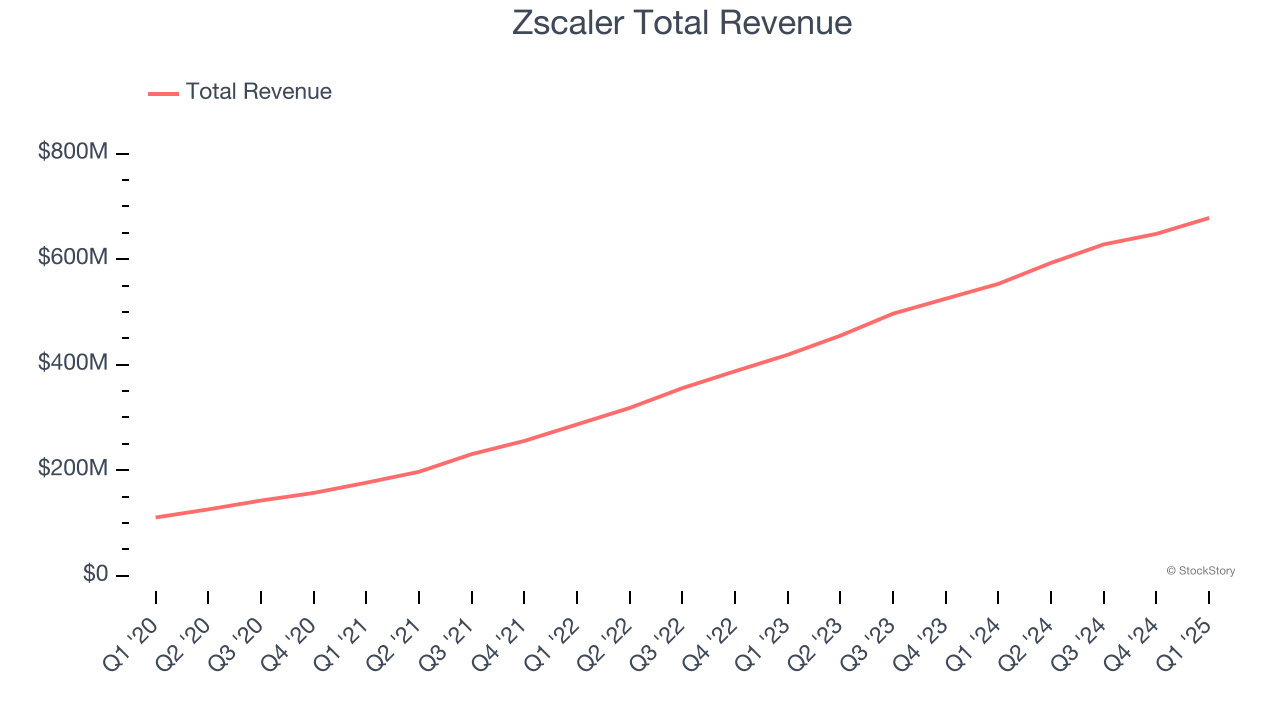

After successfully selling all four of his previous cybersecurity companies, Jay Chaudhry's fifth venture, Zscaler (NASDAQ: ZS) offers software-as-a-service that helps companies securely connect to applications and networks in the cloud.

Zscaler reported revenues of $678 million, up 22.6% year on year, outperforming analysts’ expectations by 1.6%. The business had a very strong quarter with full-year EPS guidance exceeding analysts’ expectations and a solid beat of analysts’ annual recurring revenue estimates.

Zscaler scored the highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 13.4% since reporting. It currently trades at $284.47.

Is now the time to buy Zscaler? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: SentinelOne (NYSE: S)

With roots in the Israeli cyber intelligence community, SentinelOne (NYSE: S) provides software to help organizations efficiently detect, prevent, and investigate cyber attacks.

SentinelOne reported revenues of $229 million, up 22.9% year on year, in line with analysts’ expectations. It was a mixed quarter as it posted an impressive beat of analysts’ EBITDA estimates but a miss of analysts’ billings estimates.

The stock is flat since the results and currently trades at $19.58.

Read our full analysis of SentinelOne’s results here.

Okta (NASDAQ: OKTA)

Founded during the aftermath of the financial crisis in 2009, Okta (NASDAQ: OKTA) is a cloud-based software-as-a-service platform that helps companies manage identity for their employees and customers.

Okta reported revenues of $688 million, up 11.5% year on year. This print topped analysts’ expectations by 1.2%. Zooming out, it was a satisfactory quarter as it also logged EPS guidance for next quarter exceeding analysts’ expectations but a miss of analysts’ billings estimates.

The stock is down 21.8% since reporting and currently trades at $98.19.

Read our full, actionable report on Okta here, it’s free.

CrowdStrike (NASDAQ: CRWD)

Founded by George Kurtz, the former CTO of the antivirus company McAfee, CrowdStrike (NASDAQ: CRWD) provides cybersecurity software that protects companies from breaches and helps them detect and respond to cyber attacks.

CrowdStrike reported revenues of $1.10 billion, up 19.8% year on year. This result met analysts’ expectations. Taking a step back, it was a satisfactory quarter as it also produced an impressive beat of analysts’ EBITDA estimates but revenue guidance for next quarter meeting analysts’ expectations.

CrowdStrike had the weakest performance against analyst estimates among its peers. The stock is down 5.5% since reporting and currently trades at $461.88.

Read our full, actionable report on CrowdStrike here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.