Independent Bank has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 5.5% to $66.94 per share while the index has gained 5%.

Is there a buying opportunity in Independent Bank, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is Independent Bank Not Exciting?

We're sitting this one out for now. Here are three reasons why we avoid INDB and a stock we'd rather own.

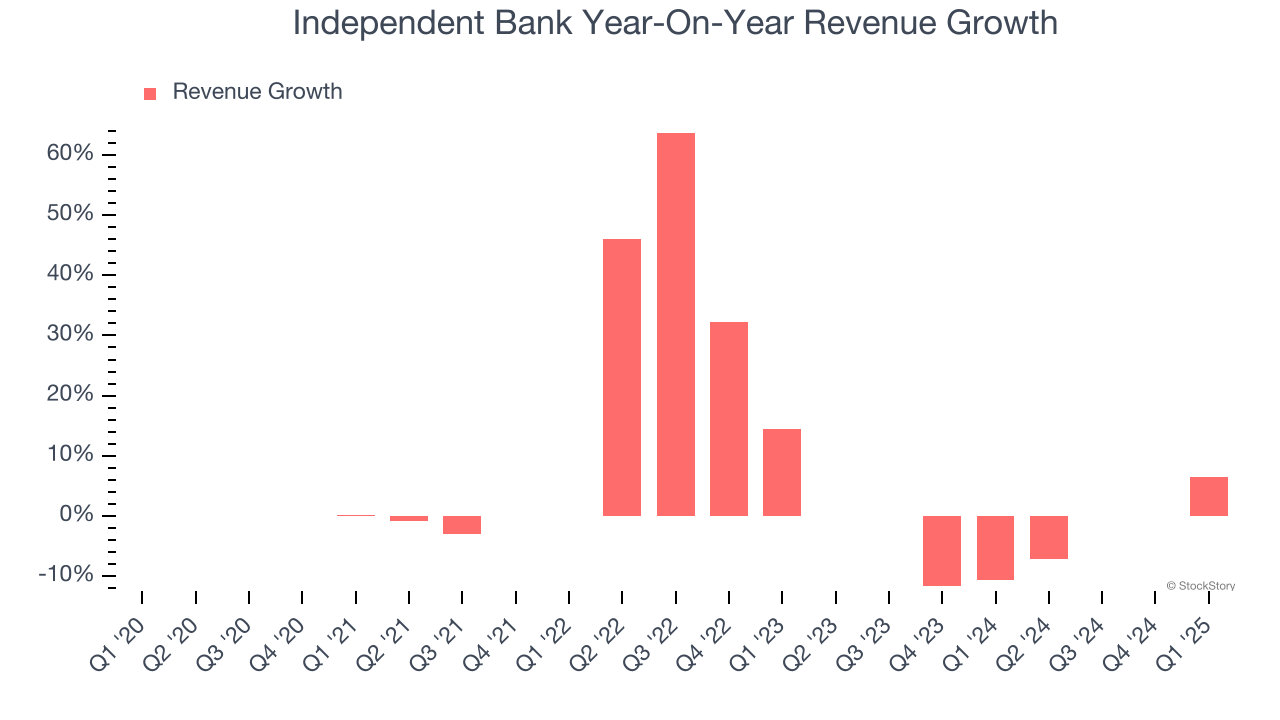

1. Revenue Tumbling Downwards

We at StockStory place the most emphasis on long-term growth, but within financials, a stretched historical view may miss recent interest rate changes, market returns, and industry trends. Independent Bank’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 3.5% over the last two years.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

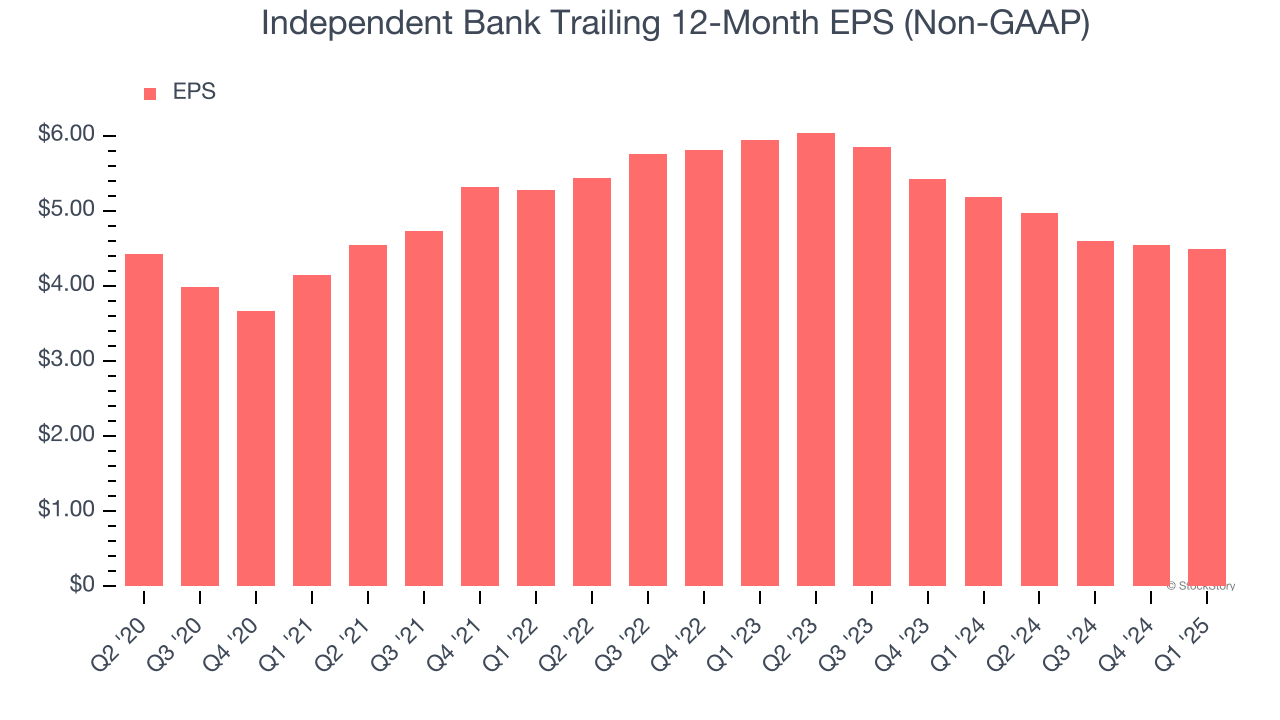

2. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Independent Bank, its EPS declined by 2.2% annually over the last five years while its revenue grew by 6%. This tells us the company became less profitable on a per-share basis as it expanded.

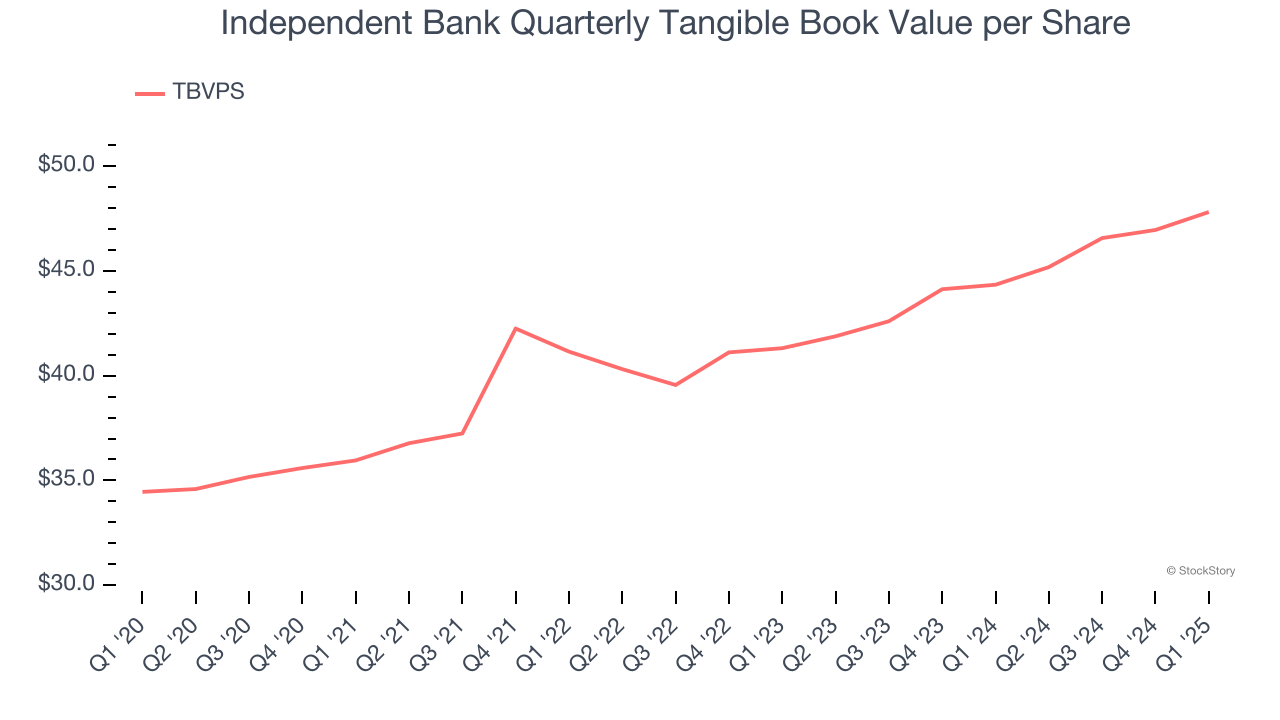

3. TBVPS Projections Show Stormy Skies Ahead

Tangible book value per share (TBVPS) growth comes from a bank’s ability to profitably lend while maintaining prudent risk management and efficient operations.

Over the next 12 months, Consensus estimates call for Independent Bank’s TBVPS to shrink by 2.3% to $46.72, a sour projection.

Final Judgment

Independent Bank isn’t a terrible business, but it isn’t one of our picks. That said, the stock currently trades at 0.9× forward P/B (or $66.94 per share). At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere. Let us point you toward one of our top digital advertising picks.

Stocks We Like More Than Independent Bank

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.