Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Applied Digital (NASDAQ: APLD) and the best and worst performers in the it services & other tech industry.

The IT and tech services subsector is poised for growth as businesses accelerate cloud adoption, AI-driven network automation, and edge computing deployments. While these seem like big, nebulous trends, they require very real products like switches and firewalls as well as implementation services. On the other hand, challenges on the horizon include intensifying competition from cloud-native networking providers, regulatory scrutiny over data privacy and cybersecurity, and potential supply chain constraints for networking hardware. While AI and automation will enhance network efficiency and security, they also introduce risks related to algorithmic bias, compliance complexity, and increased energy consumption.

The 19 it services & other tech stocks we track reported a mixed Q1. As a group, revenues along with next quarter’s revenue guidance were in line with analysts’ consensus estimates.

Luckily, it services & other tech stocks have performed well with share prices up 18.2% on average since the latest earnings results.

Applied Digital (NASDAQ: APLD)

Pivoting from its origins in cryptocurrency mining to become a key player in the AI infrastructure boom, Applied Digital (NASDAQ: APLD) designs and operates specialized data centers that provide high-performance computing infrastructure for artificial intelligence and blockchain applications.

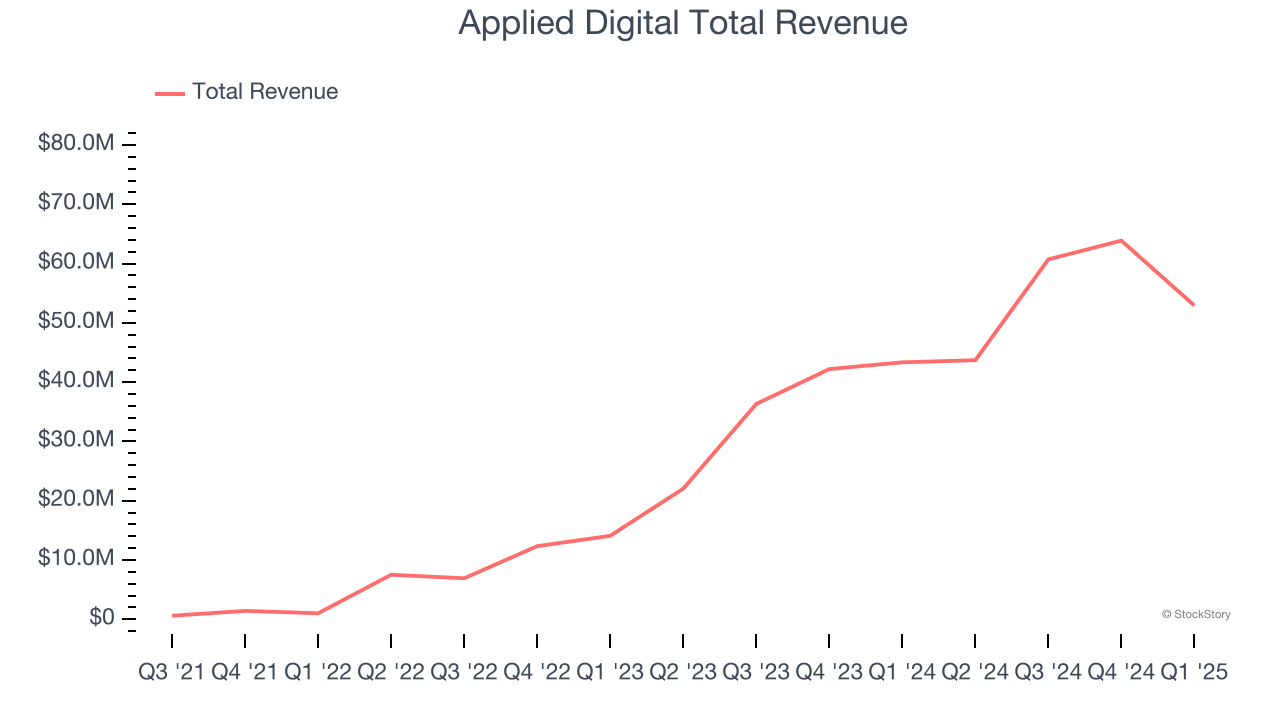

Applied Digital reported revenues of $52.92 million, up 22.1% year on year. This print fell short of analysts’ expectations by 17.9%, but it was still a satisfactory quarter for the company with an impressive beat of analysts’ EPS estimates.

"We are confident in the progress we are making and remain committed to delivering sustainable, long-term value for our investors,” said Applied Digital Chairman and CEO Wes Cummins.

Applied Digital delivered the weakest performance against analyst estimates of the whole group. Interestingly, the stock is up 93.3% since reporting and currently trades at $10.39.

Is now the time to buy Applied Digital? Access our full analysis of the earnings results here, it’s free.

Best Q1: Grid Dynamics (NASDAQ: GDYN)

With engineering centers across the Americas, Europe, and India serving Fortune 1000 companies, Grid Dynamics (NASDAQ: GDYN) provides technology consulting, engineering, and analytics services to help large enterprises modernize their technology systems and business processes.

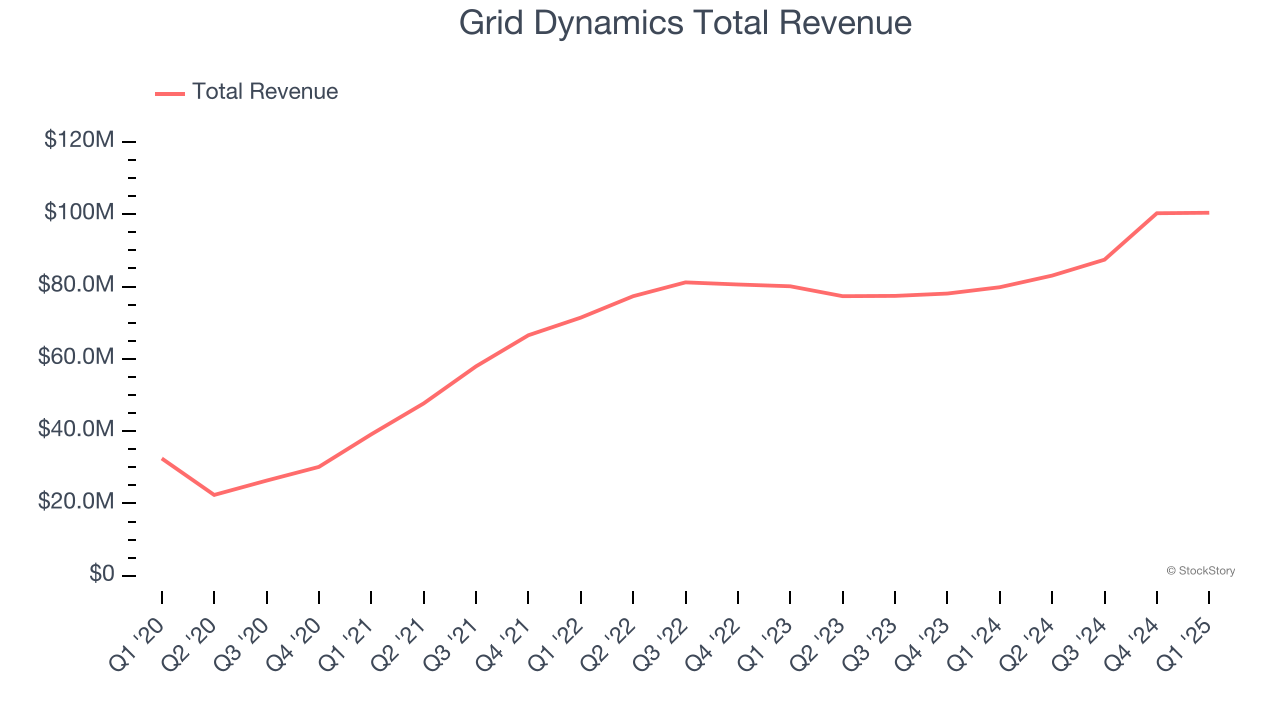

Grid Dynamics reported revenues of $100.4 million, up 25.8% year on year, outperforming analysts’ expectations by 2%. The business had a very strong quarter with an impressive beat of analysts’ EPS estimates and full-year revenue guidance beating analysts’ expectations.

Grid Dynamics delivered the fastest revenue growth among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 12% since reporting. It currently trades at $12.39.

Is now the time to buy Grid Dynamics? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: HP (NYSE: HPQ)

Born from the legendary Silicon Valley garage startup founded by Bill Hewlett and Dave Packard in 1939, HP (NYSE: HPQ) designs and sells personal computers, printers, and related technology products and services to consumers, businesses, and enterprises worldwide.

HP reported revenues of $13.22 billion, up 3.3% year on year, exceeding analysts’ expectations by 0.9%. Still, it was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

As expected, the stock is down 4.7% since the results and currently trades at $26.

Read our full analysis of HP’s results here.

Dell (NYSE: DELL)

Founded by Michael Dell in his University of Texas dorm room in 1984 with just $1,000, Dell Technologies (NYSE: DELL) provides hardware, software, and services that help organizations build their IT infrastructure, manage cloud environments, and enable digital transformation.

Dell reported revenues of $23.38 billion, up 5.1% year on year. This number topped analysts’ expectations by 1.1%. Zooming out, it was a softer quarter as it logged a significant miss of analysts’ operating income estimates.

The stock is up 10.3% since reporting and currently trades at $125.22.

Read our full, actionable report on Dell here, it’s free.

ASGN (NYSE: ASGN)

Evolving from its roots in IT staffing to become a high-end technology consulting powerhouse, ASGN (NYSE: ASGN) provides specialized IT consulting services and staffing solutions to Fortune 1000 companies and U.S. federal government agencies.

ASGN reported revenues of $968.3 million, down 7.7% year on year. This print beat analysts’ expectations by 0.6%. More broadly, it was a slower quarter as it recorded a significant miss of analysts’ EPS guidance for next quarter estimates and a miss of analysts’ EPS estimates.

The stock is down 9.7% since reporting and currently trades at $52.84.

Read our full, actionable report on ASGN here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.