What a fantastic six months it’s been for Dollar General. Shares of the company have skyrocketed 48.4%, hitting $112.99. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy Dollar General, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is Dollar General Not Exciting?

We’re happy investors have made money, but we're sitting this one out for now. Here are three reasons why DG doesn't excite us and a stock we'd rather own.

1. Flat Same-Store Sales Indicate Weak Demand

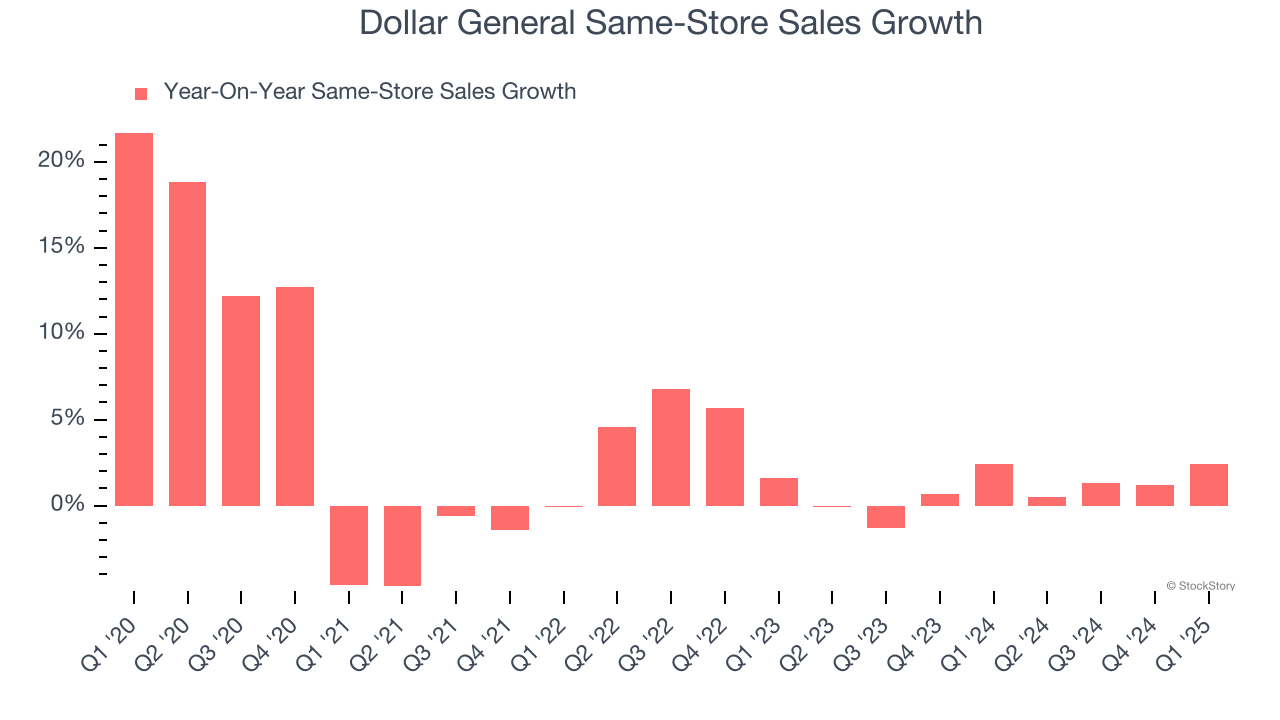

Same-store sales show the change in sales for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year. This is a key performance indicator because it measures organic growth.

Dollar General’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat.

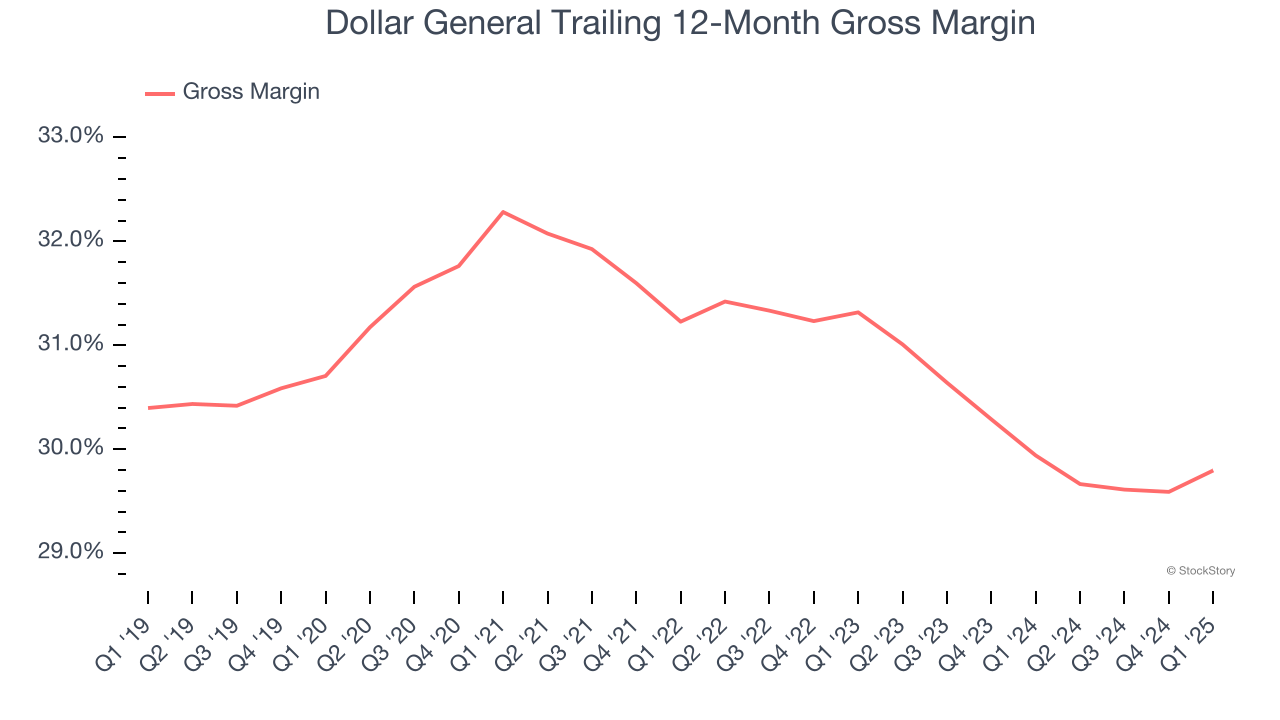

2. Low Gross Margin Reveals Weak Structural Profitability

At StockStory, we prefer high gross margin businesses because they indicate pricing power or differentiated products, giving the company a chance to generate higher operating profits.

Dollar General has bad unit economics for a retailer, signaling it operates in a competitive market and lacks pricing power because its inventory is sold in many places. As you can see below, it averaged a 29.9% gross margin over the last two years. Said differently, Dollar General had to pay a chunky $70.13 to its suppliers for every $100 in revenue.

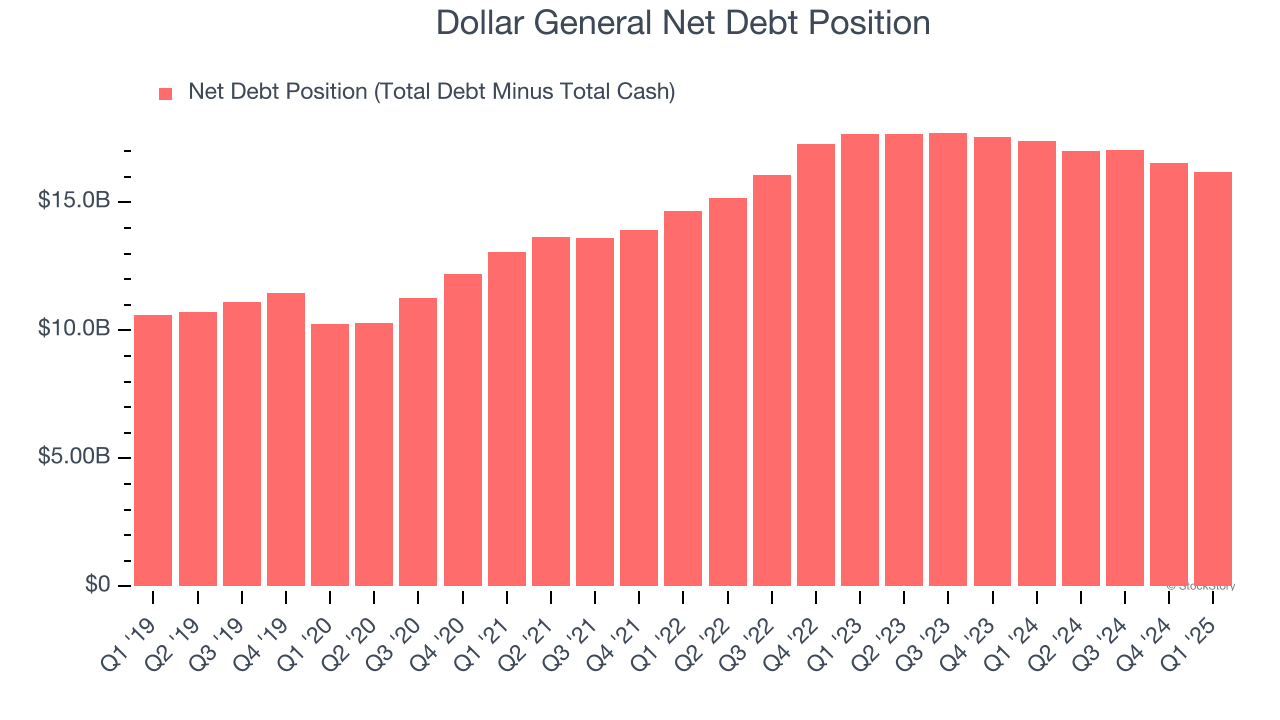

3. High Debt Levels Increase Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

Dollar General’s $17.02 billion of debt exceeds the $850 million of cash on its balance sheet. Furthermore, its 5× net-debt-to-EBITDA ratio (based on its EBITDA of $2.97 billion over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Dollar General could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Dollar General can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

Dollar General isn’t a terrible business, but it isn’t one of our picks. After the recent rally, the stock trades at 19.4× forward P/E (or $112.99 per share). Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now. Let us point you toward one of our top digital advertising picks.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.