Global airline Delta Air Lines (NYSE: DAL) announced better-than-expected revenue in Q4 CY2025, with sales up 2.9% year on year to $16 billion. Guidance for next quarter’s revenue was better than expected at $14.88 billion at the midpoint, 1.1% above analysts’ estimates. Its GAAP profit of $1.86 per share was 18.7% above analysts’ consensus estimates.

Is now the time to buy Delta? Find out by accessing our full research report, it’s free.

Delta (DAL) Q4 CY2025 Highlights:

- Revenue: $16 billion vs analyst estimates of $15.75 billion (2.9% year-on-year growth, 1.6% beat)

- EPS (GAAP): $1.86 vs analyst estimates of $1.57 (18.7% beat)

- Adjusted EBITDA: $2.09 billion vs analyst estimates of $2.23 billion (13% margin, 6.6% miss)

- Revenue Guidance for Q1 CY2026 is $14.88 billion at the midpoint, above analyst estimates of $14.72 billion

- EPS (GAAP) guidance for the upcoming financial year 2026 is $7 at the midpoint, missing analyst estimates by 4.3%

- Operating Margin: 9.2%, down from 11% in the same quarter last year

- Free Cash Flow Margin: 8.4%, up from 3.9% in the same quarter last year

- Revenue Passenger Miles: 59.86 billion, in line with the same quarter last year

- Market Capitalization: $46.07 billion

"The Delta team delivered a strong close to our Centennial year, demonstrating the differentiation and durability we've built. Our industry-leading performance delivered for our customers and our employees, while creating value for our owners, consistent with our long-term financial framework. We generated $5 billion of pre-tax profit with a double-digit operating margin and record free cash flow of $4.6 billion, all while navigating a challenging environment. These results would not be possible without the exceptional efforts of our people and I look forward to celebrating our team next month with $1.3 billion of well-earned profit sharing," said Ed Bastian, Delta's chief executive officer.

Company Overview

One of the ‘Big Four’ airlines in the US, Delta Air Lines (NYSE: DAL) is a major global air carrier that serves both business and leisure travelers through its domestic and international flights.

Revenue Growth

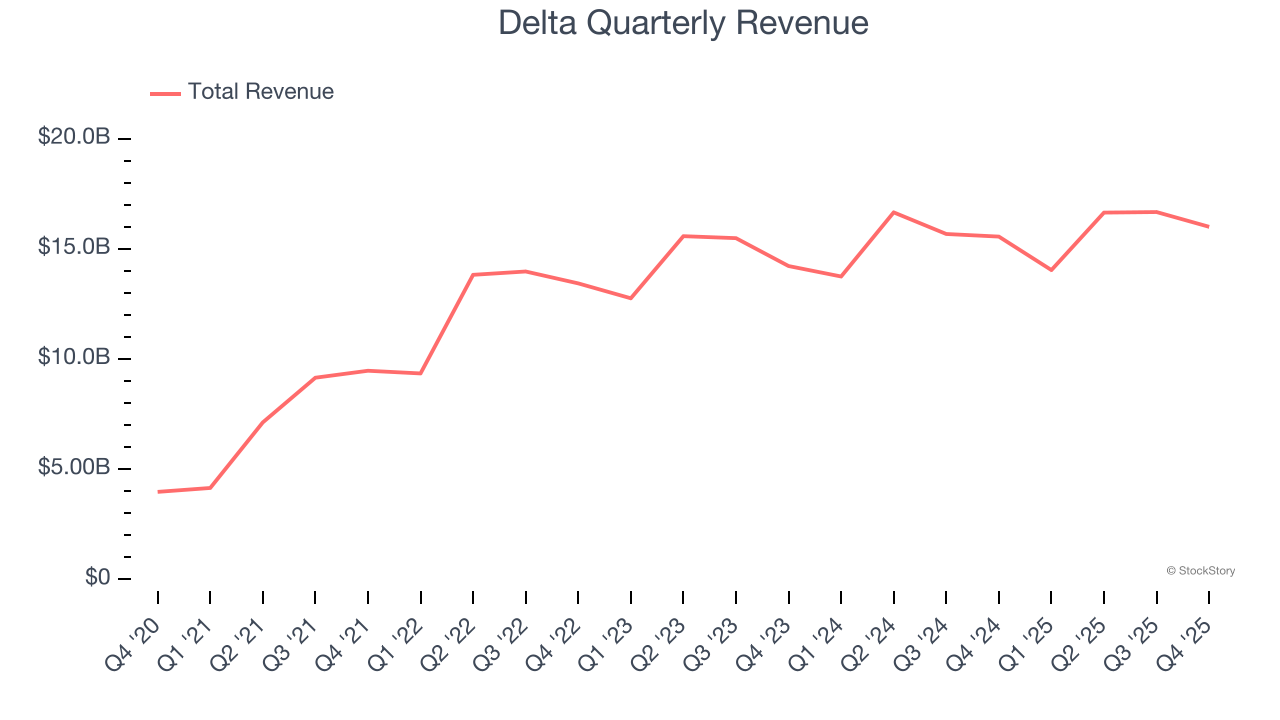

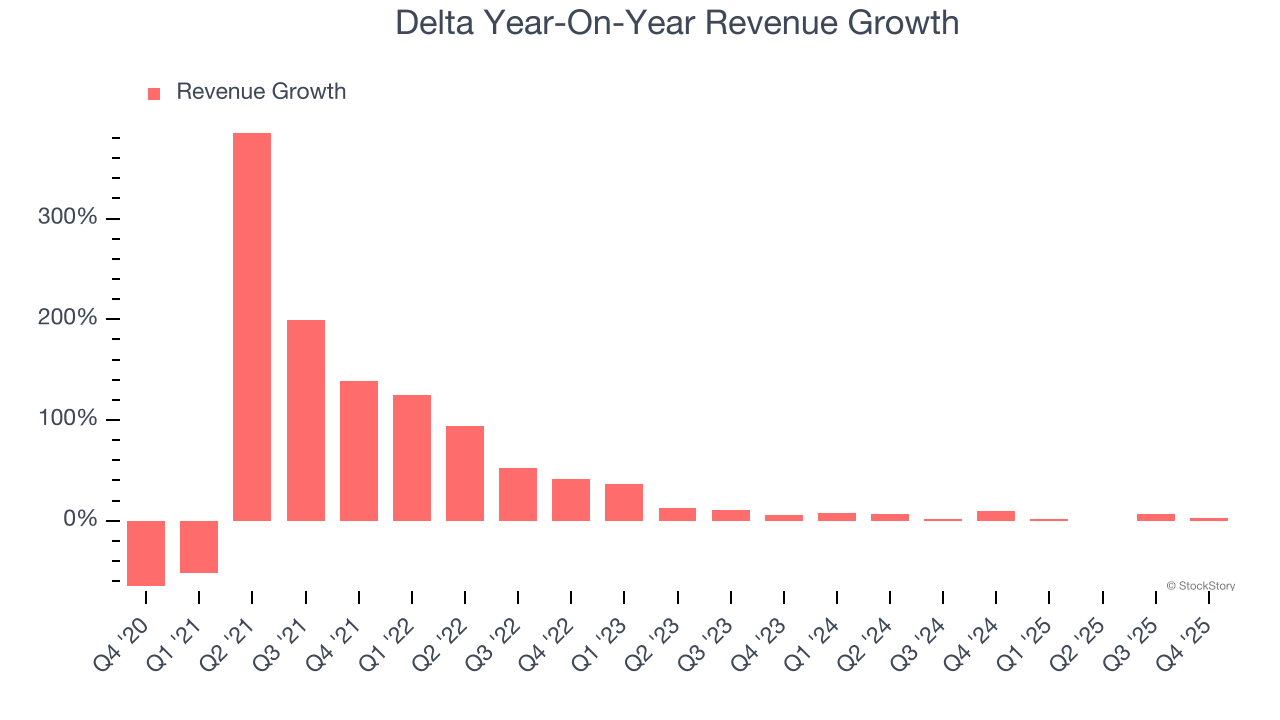

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Delta grew its sales at a 30% annual rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Delta’s recent performance shows its demand has slowed as its annualized revenue growth of 4.5% over the last two years was below its five-year trend.

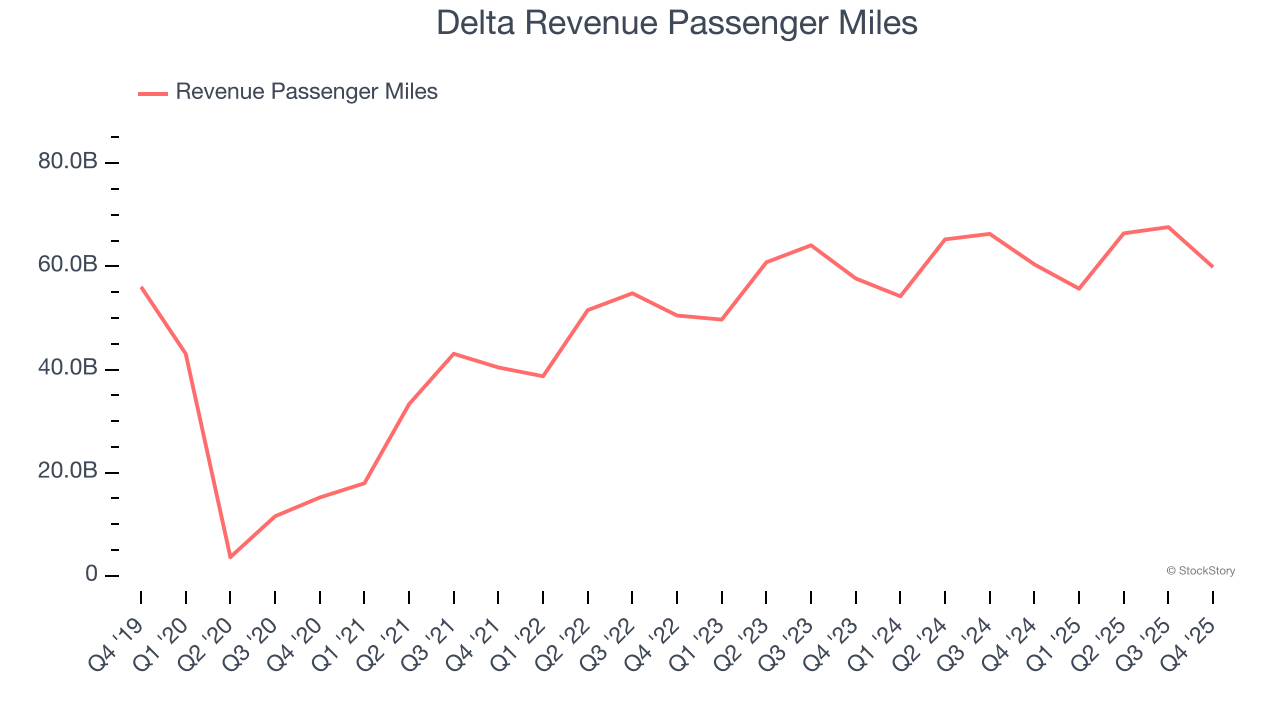

We can dig further into the company’s revenue dynamics by analyzing its number of revenue passenger miles, which reached 59.86 billion in the latest quarter. Over the last two years, Delta’s revenue passenger miles averaged 3.8% year-on-year growth. Because this number aligns with its revenue growth during the same period, we can see the company’s monetization was fairly consistent.

This quarter, Delta reported modest year-on-year revenue growth of 2.9% but beat Wall Street’s estimates by 1.6%. Company management is currently guiding for a 6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.8% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and implies its newer products and services will not catalyze better top-line performance yet.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Operating Margin

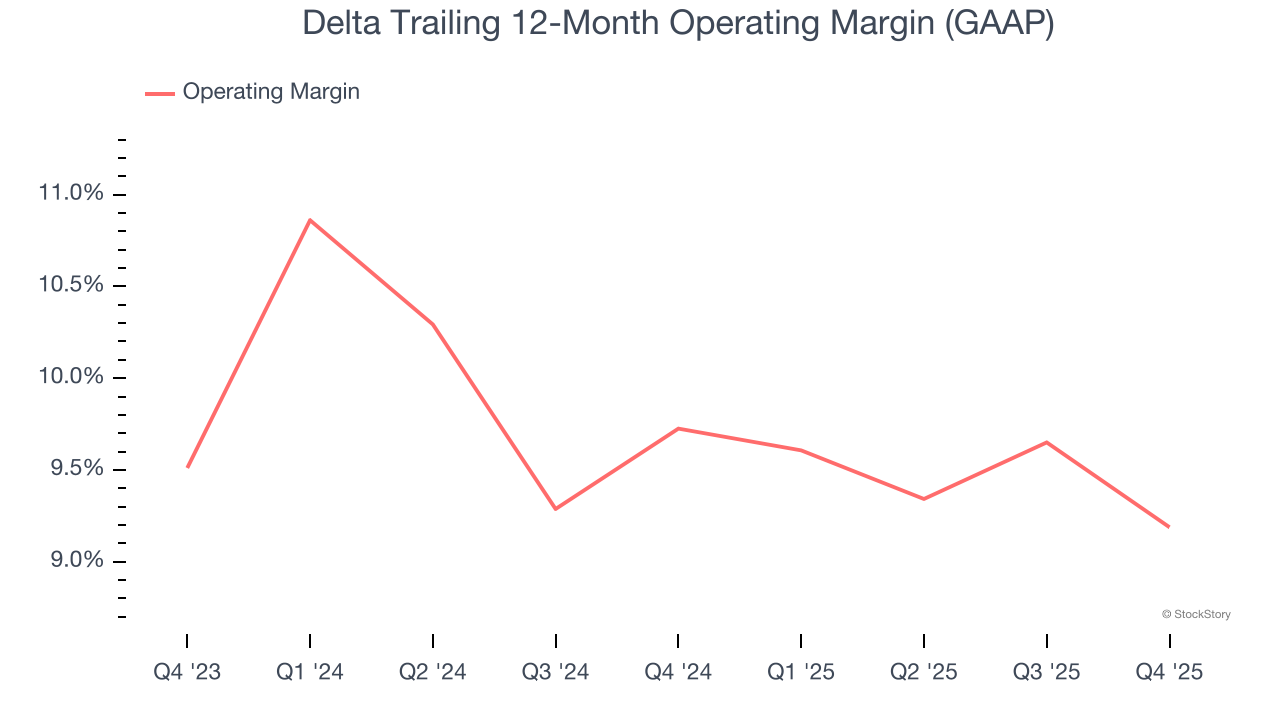

Delta’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 9.5% over the last two years. This profitability was inadequate for a consumer discretionary business and caused by its suboptimal cost structure.

This quarter, Delta generated an operating margin profit margin of 9.2%, down 1.9 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

In the coming year, Wall Street expects Delta to become more profitable. Analysts are expecting the company’s trailing 12-month operating margin of 9.2% to rise to 10.5%.

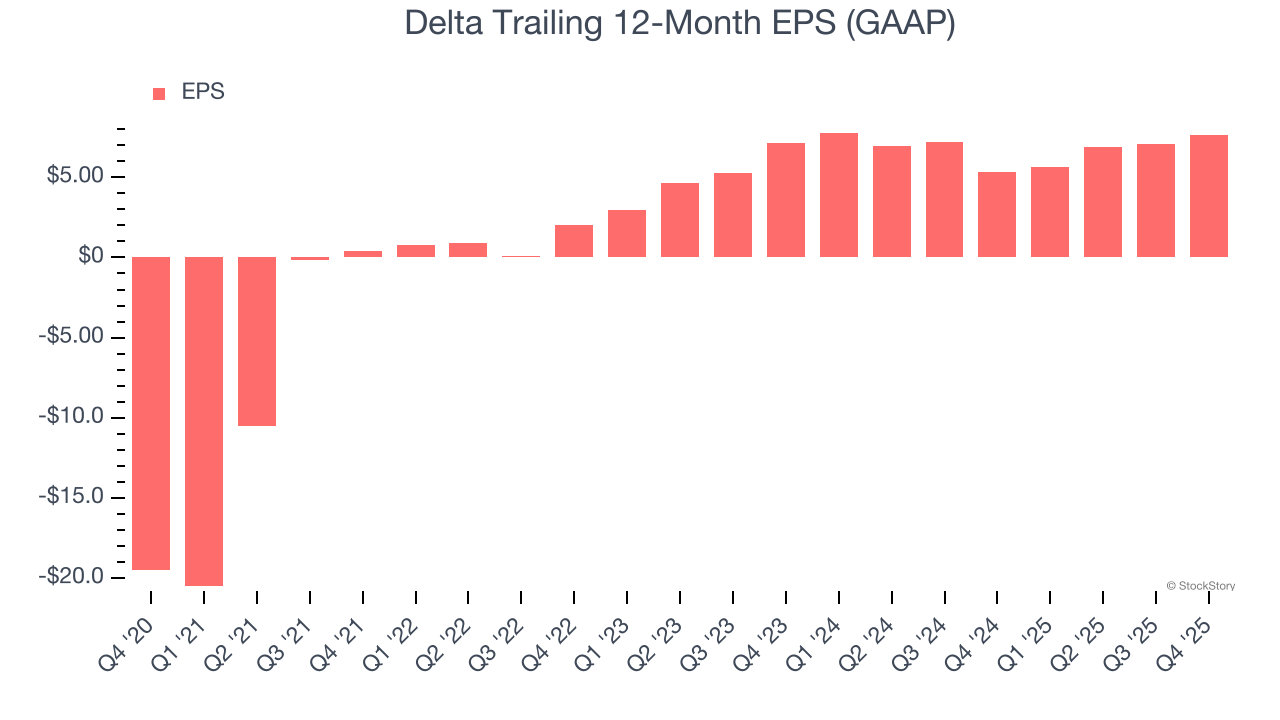

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Delta’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q4, Delta reported EPS of $1.86, up from $1.29 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Delta’s full-year EPS of $7.67 to shrink by 6.9%. This is unusual as its revenue and operating margin are anticipated to increase, signaling the fall likely stems from "below-the-line" items such as taxes.

Key Takeaways from Delta’s Q4 Results

It was good to see Delta beat analysts’ EPS expectations this quarter. We were also glad its revenue guidance for next quarter slightly exceeded Wall Street’s estimates. On the other hand, its number of revenue passenger miles missed and its full-year EPS guidance fell short of Wall Street’s estimates. Zooming out, we think this was a mixed quarter. Investors were likely hoping for more, and shares traded down 5.1% to $67.21 immediately after reporting.

Big picture, is Delta a buy here and now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).