Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Genco (NYSE: GNK) and the best and worst performers in the marine transportation industry.

The growth of e-commerce and global trade continues to drive demand for shipping services, presenting opportunities for marine transportation companies. While ocean freight is more fuel efficient and therefore cheaper than its air and ground counterparts, it results in slower delivery times, presenting a trade off. To improve transit speeds, the industry continues to invest in digitization to optimize fleets and routes. However, marine transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins. Geopolitical tensions can also affect access to trade routes, and if certain countries are banned from using passageways like the Panama Canal, costs can spiral out of control.

The 5 marine transportation stocks we track reported a satisfactory Q1. As a group, revenues missed analysts’ consensus estimates by 1%.

In light of this news, share prices of the companies have held steady as they are up 3.3% on average since the latest earnings results.

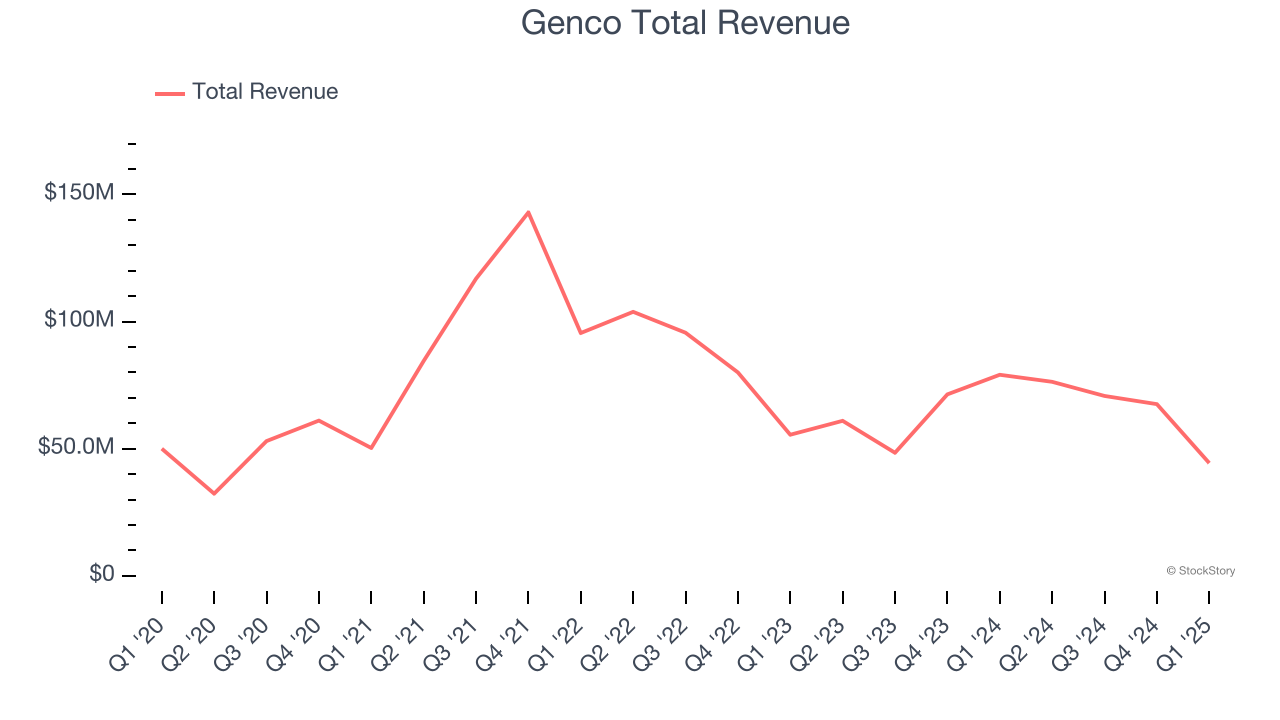

Genco (NYSE: GNK)

Headquartered in NYC, Genco (NYSE: GNK) is a shipping company that transports dry bulk cargo along worldwide maritime routes.

Genco reported revenues of $44.35 million, down 43.9% year on year. This print exceeded analysts’ expectations by 4.8%. Overall, it was a strong quarter for the company with a decent beat of analysts’ adjusted operating income estimates.

John C. Wobensmith, Chief Executive Officer, commented, “Coming off a year of earnings growth and strong execution of our comprehensive value strategy, we have entered 2025 by declaring our 23ʳᵈ consecutive dividend despite a seasonally softer first quarter. Including the Q1 dividend, total dividends to shareholders will amount to $6.765 per share, or approximately 50% of our current stock price, highlighting our track record and commitment to dividends through market cycles.”

Genco achieved the biggest analyst estimates beat of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 3.1% since reporting and currently trades at $13.04.

Is now the time to buy Genco? Access our full analysis of the earnings results here, it’s free.

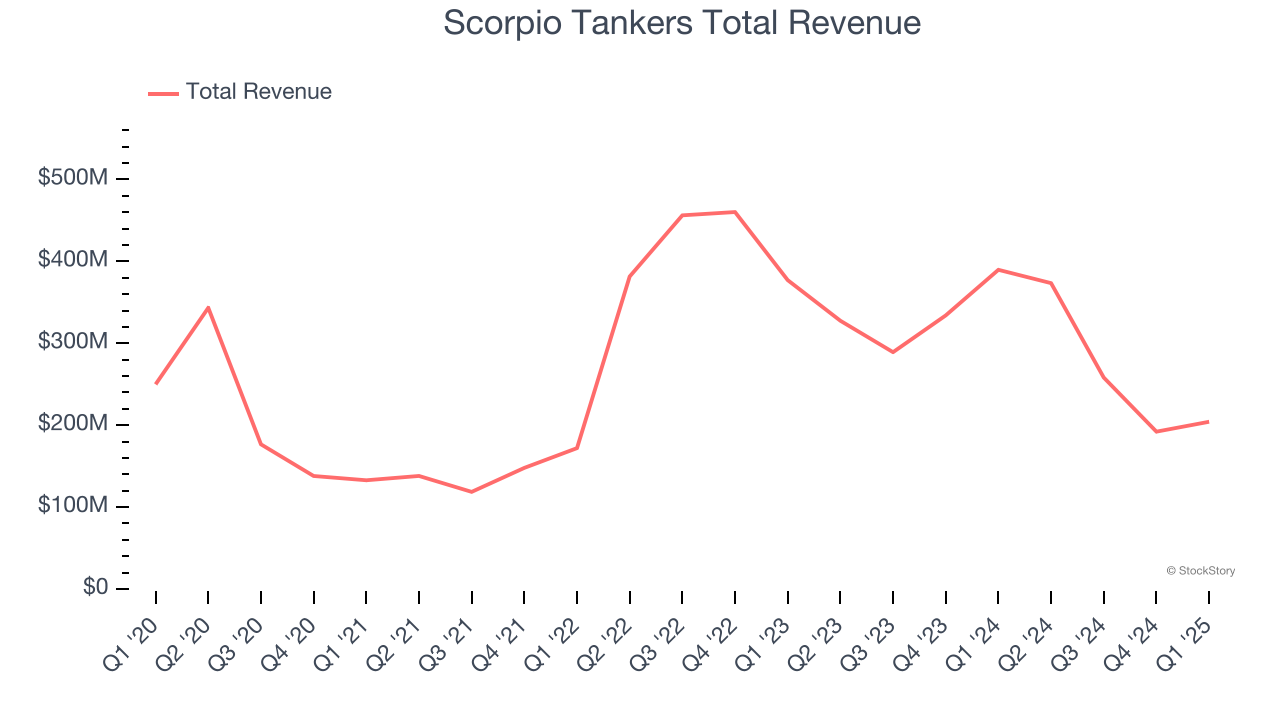

Best Q1: Scorpio Tankers (NYSE: STNG)

Operating one of the youngest fleets in the industry, Scorpio Tankers (NYSE: STNG) is an international provider of marine transportation services, specializing in the shipment of refined petroleum.

Scorpio Tankers reported revenues of $204.2 million, down 47.6% year on year, outperforming analysts’ expectations by 1.7%. The business had a stunning quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

The market seems content with the results as the stock is up 4.7% since reporting. It currently trades at $39.46.

Is now the time to buy Scorpio Tankers? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Matson (NYSE: MATX)

Founded by a Swedish orphan, Matson (NYSE: MATX) is a provider of ocean transportation and logistics services.

Matson reported revenues of $782 million, up 8.3% year on year, falling short of analysts’ expectations by 4.4%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income and sales volume estimates.

Matson delivered the weakest performance against analyst estimates in the group. The stock is flat since the results and currently trades at $110.79.

Read our full analysis of Matson’s results here.

Pangaea (NASDAQ: PANL)

Established in 1996, Pangaea Logistics (NASDAQ: PANL) specializes in global logistics and transportation services, focusing on the shipment of dry bulk cargoes.

Pangaea reported revenues of $122.8 million, up 17.2% year on year. This result lagged analysts' expectations by 4.4%. Taking a step back, it was still a strong quarter as it put up a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Pangaea pulled off the fastest revenue growth among its peers. The stock is up 3.1% since reporting and currently trades at $4.56.

Read our full, actionable report on Pangaea here, it’s free.

Kirby (NYSE: KEX)

Transporting goods along all U.S. coasts, Kirby (NYSE: KEX) provides inland and coastal marine transportation services.

Kirby reported revenues of $785.7 million, down 2.8% year on year. This print came in 2.7% below analysts' expectations. It was a slower quarter as it also produced a miss of analysts’ Distribution and Services revenue estimates and adjusted operating income in line with analysts’ estimates.

The stock is up 11.4% since reporting and currently trades at $107.19.

Read our full, actionable report on Kirby here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.