Maritime shipping company Genco (NYSE: GNK) reported revenue ahead of Wall Street’s expectations in Q1 CY2025, but sales fell by 9.9% year on year to $71.27 million. Its non-GAAP loss of $0.28 per share was in line with analysts’ consensus estimates.

Is now the time to buy Genco? Find out by accessing our full research report, it’s free.

Genco (GNK) Q1 CY2025 Highlights:

- Revenue: $71.27 million vs analyst estimates of $42.31 million (9.9% year-on-year decline, 68.5% beat)

- Adjusted EPS: -$0.28 vs analyst estimates of -$0.28 (in line)

- Adjusted EBITDA: $7.92 million vs analyst estimates of $7.79 million (11.1% margin, 1.6% beat)

- Operating Margin: -13.7%, down from 27.9% in the same quarter last year

- Free Cash Flow was -$595,000, down from $31.08 million in the same quarter last year

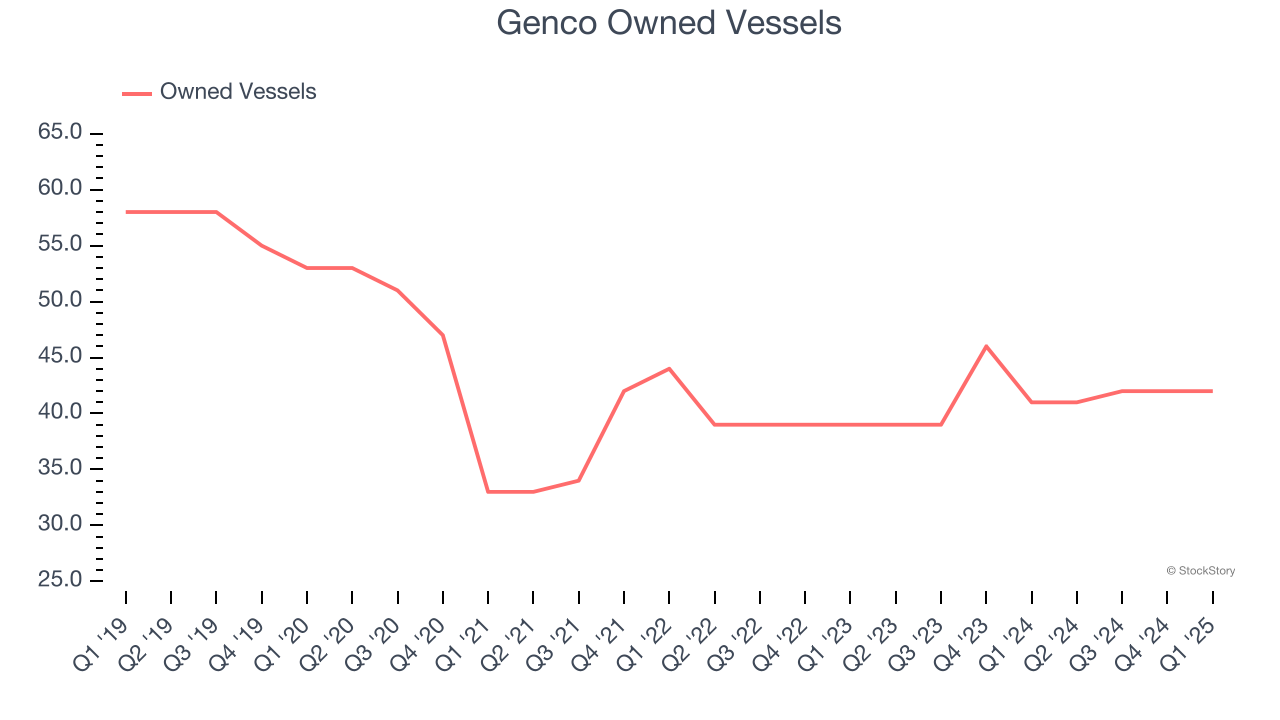

- owned vessels: 42, up 1 year on year

- Market Capitalization: $577.4 million

John C. Wobensmith, Chief Executive Officer, commented, “Coming off a year of earnings growth and strong execution of our comprehensive value strategy, we have entered 2025 by declaring our 23ʳᵈ consecutive dividend despite a seasonally softer first quarter. Including the Q1 dividend, total dividends to shareholders will amount to $6.765 per share, or approximately 50% of our current stock price, highlighting our track record and commitment to dividends through market cycles.”

Company Overview

Headquartered in NYC, Genco (NYSE: GNK) is a shipping company that transports dry bulk cargo along worldwide maritime routes.

Sales Growth

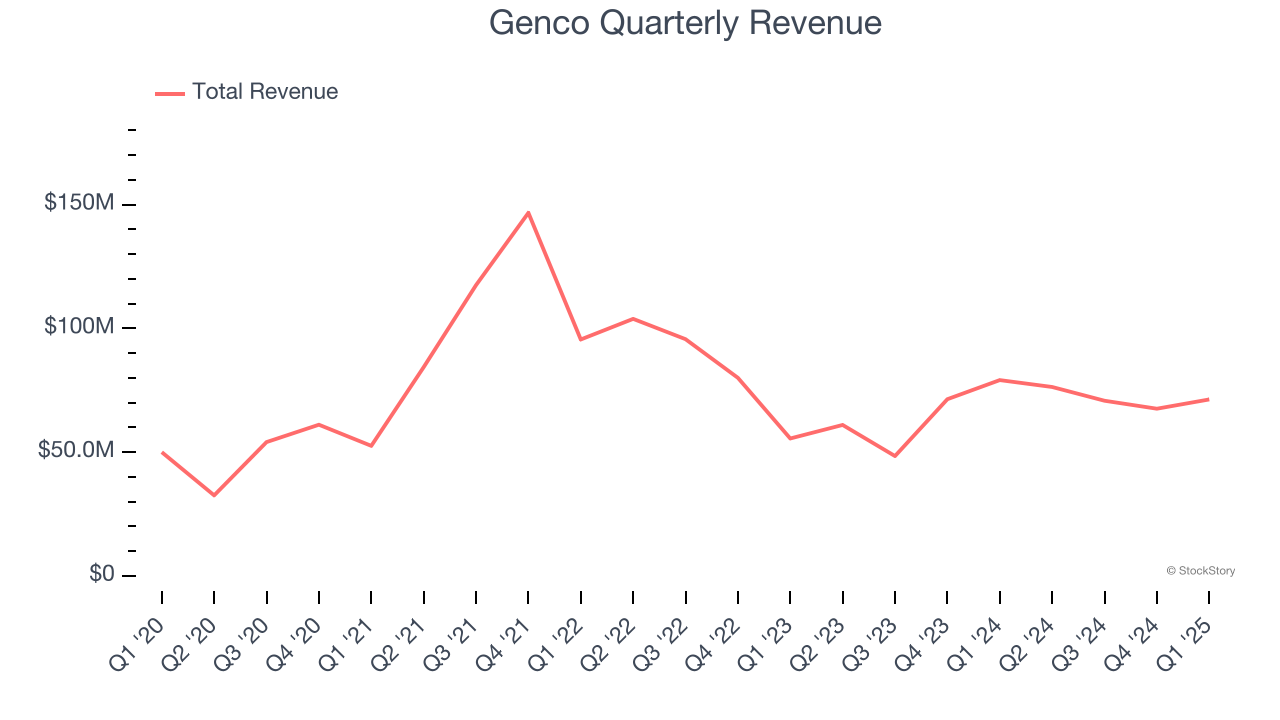

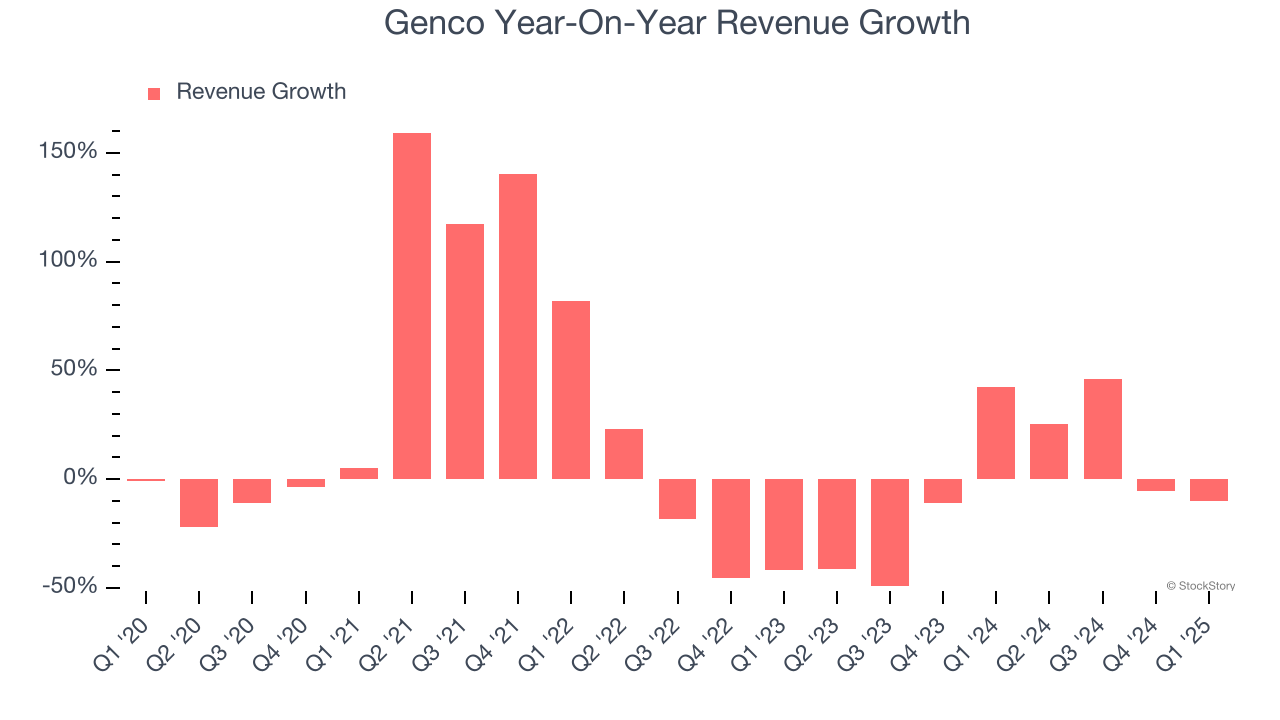

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Genco grew its sales at a tepid 5.8% compounded annual growth rate. This was below our standard for the industrials sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Genco’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 7.6% annually. Genco isn’t alone in its struggles as the Marine Transportation industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

We can dig further into the company’s revenue dynamics by analyzing its number of owned vessels, which reached 42 in the latest quarter. Over the last two years, Genco’s owned vessels averaged 3.7% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Genco’s revenue fell by 9.9% year on year to $71.27 million but beat Wall Street’s estimates by 68.5%.

Looking ahead, sell-side analysts expect revenue to decline by 10.1% over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and suggests its products and services will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

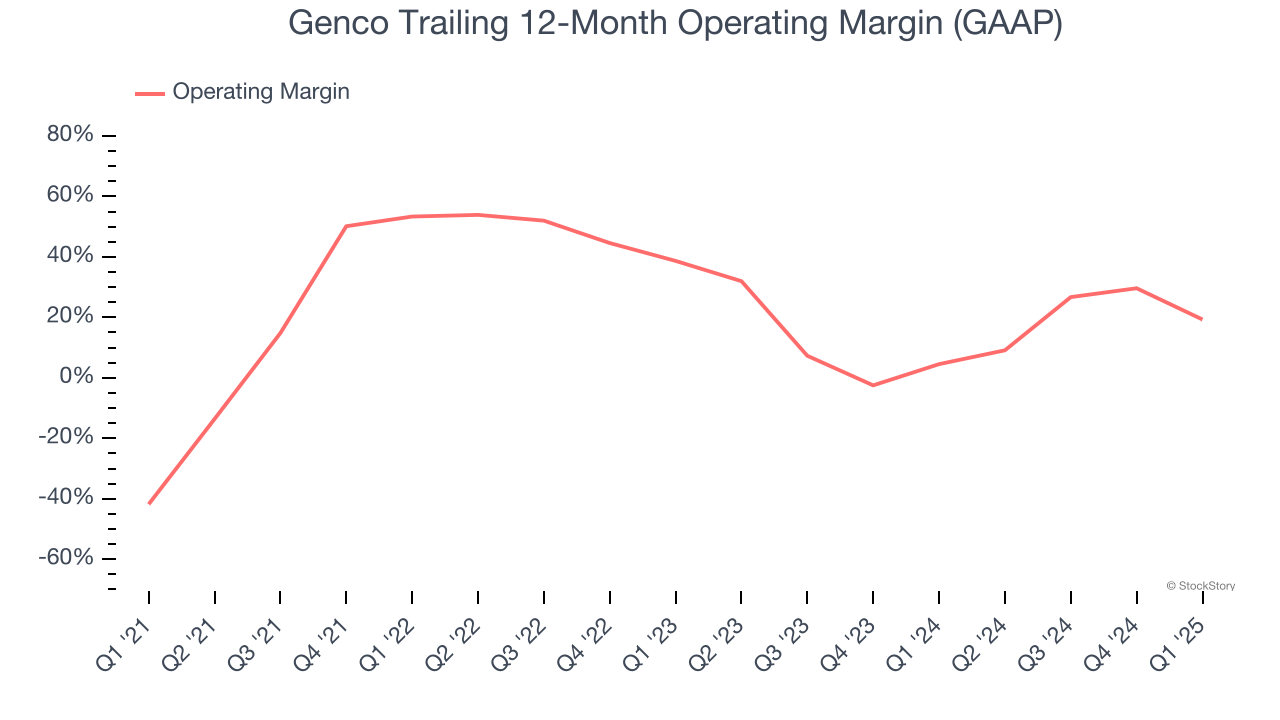

Genco has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 22.9%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Genco’s operating margin rose by 61.1 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Genco generated an operating profit margin of negative 13.7%, down 41.6 percentage points year on year. Since Genco’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

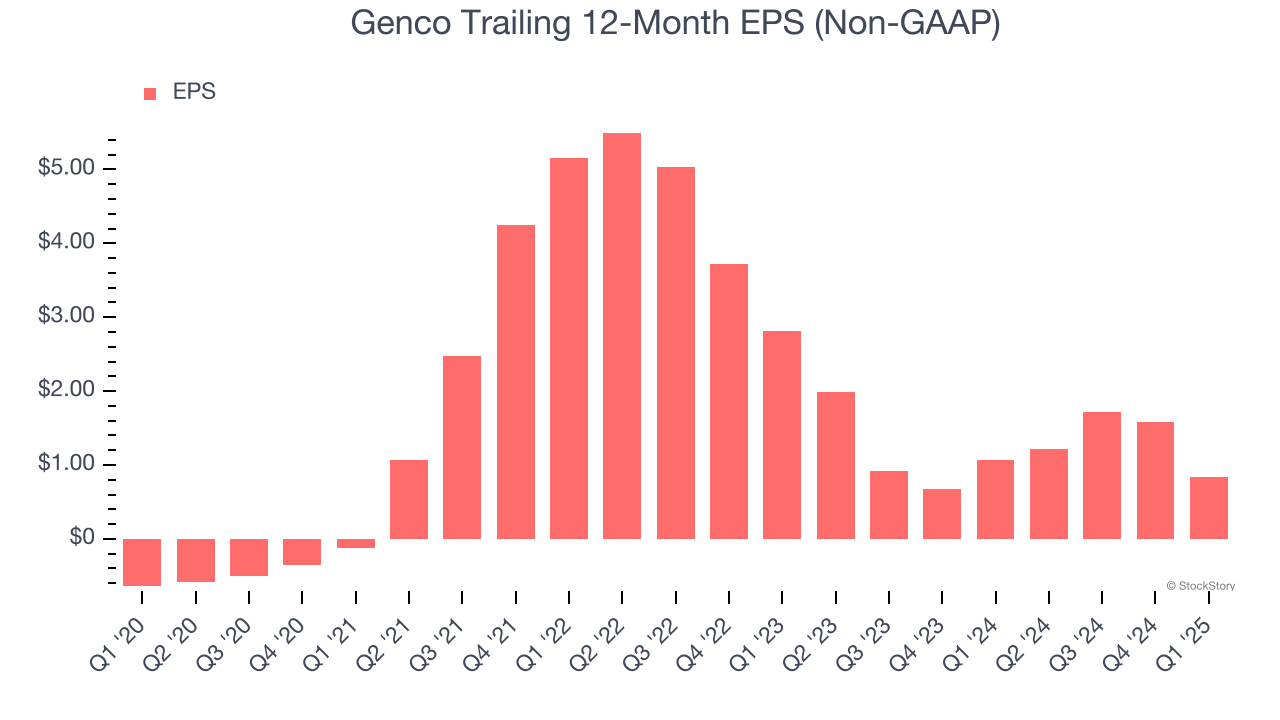

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Genco’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for Genco, its EPS declined by more than its revenue over the last two years, dropping 45.3%. This tells us the company struggled to adjust to shrinking demand.

Diving into the nuances of Genco’s earnings can give us a better understanding of its performance. Genco’s operating margin has declined by 21.7 percentage points over the last two years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q1, Genco reported EPS at negative $0.28, down from $0.46 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Genco’s full-year EPS of $0.84 to shrink by 22.2%.

Key Takeaways from Genco’s Q1 Results

We were impressed by how significantly Genco blew past analysts’ revenue forecasts this quarter. We were also happy its EBITDA topped Wall Street’s estimates, but we would have expected a bigger profit beat given the massive top-line outperformance. Nevertheless, we think this was a solid quarter with some key areas of upside. The stock traded up 1.8% to $13.70 immediately after reporting.

Genco put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.