Investing in blue chip stocks has been a tried-and-true method of wealth creation for American investors for more than a century.

When you think of blue chip stocks, you usually think of long-standing financial or industrial companies like JPMorgan Chase (NYSE: JPM) or Caterpillar Inc. (NYSE: CAT).

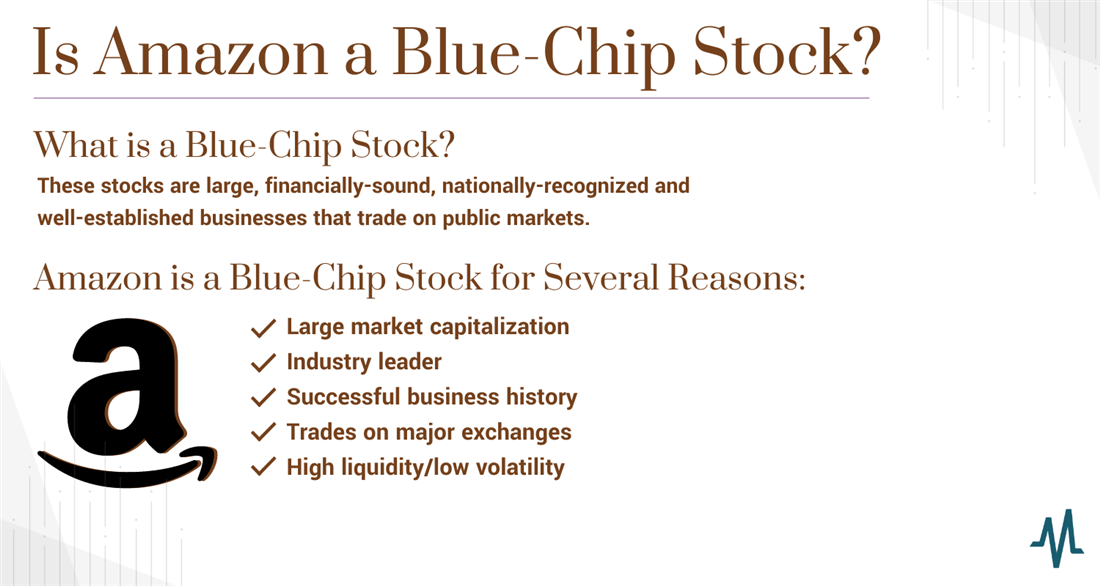

Not every company must have a century-long business history to be considered a blue chip. For example, is Amazon a blue chip stock? That's the question we'll debate in this article, and the answer may surprise you.

What is Considered a Blue-Chip Stock?

"Blue chip stock" isn't a term you can narrow down to specific qualities. Instead, blue chip status is something a company earns over time by proving its stability to investors. It's important to note that blue chips tend to underperform growth stocks over long time horizons. Still, investors who value security and reliability over maximum returns can benefit significantly from blue chip stocks.

Blue chips are among the safest and most secure stocks available compared to the whole market. While losses are inevitable in any investment, blue chips tend to suffer less than their peers in down markets and usually rebound with strength when markets stabilize. Blue-chip stocks come from different sectors and industries, but they all share some similarities: large market caps, liquid shares, strong balance sheets and positive brand recognition. Here are a few blue-chip stock examples across different sectors:

- Financials: JP Morgan Chase and Co. (NYSE: JPM), Goldman Sachs Group Inc. (NYSE: G.S.), Visa Inc. (NYSE: V), American Express Company (NYSE: AXP)

- Healthcare: UnitedHealth Group Inc. (NYSE: UNH), Merck and Co. Inc. (NYSE: MRK), Johnson & Johnson (NYSE: JNJ), Amgen Inc. (NYSE: AMGN)

- Technology: Apple Inc. (NASDAQ: AAPL), Microsoft Inc. (NASDAQ: MSFT), Intel Corp. (NASDAQ: INTC)

- Industrials: Boeing Co. (NYSE: B.A.), Caterpillar Inc. (NYSE: CAT), Lockheed Martin Corp. (NYSE: LMT)

- Consumer discretionary: Starbucks Corp. (NASDAQ: SBUX), McDonald's Corp. (NYSE: MCD), Walmart Inc. (NYSE: WMT), Walt Disney Co. (NYSE: DIS)

Overview of Amazon.com Inc.

Today, you can find any product under the sun in Amazon's vast catalog. However, in the beginning, Amazon.com Inc. (NASDAQ: AMZN) sold a single item — books! Founder and (now former) CEO Jeff Bezos created Amazon in his garage in 1994, and while he had a broad vision of becoming an online retail giant, he started with books for several reasons.

First, books are easy to acquire, store and ship. In the 1990s, e-commerce was a niche industry, and consumers were apprehensive about placing personal information online and receiving items. Books were easy items to package, and the risk of damage in transit was minimal. In addition, the public at the time wasn't interested in receiving electronics, clothes and other household items through mail or delivery.

Second, the global catalog of published books is far greater than anything a brick-and-mortar bookstore could hold. An internet bookseller was the ideal marketplace since the company could acquire and sell any text in any language. Bezos later expanded to music by selling C.D.s, video games, computer software and other consumer products. The company went public in 1997, surviving the dot-com crash and flourishing as an e-commerce leader in the succeeding years.

Amazon Total Returns Since Inception

Today, Amazon isn't just an e-commerce behemoth. Bezos launched Amazon Web Services in 2004, which offers cloud computing services to individuals, companies and governments. AWS earnings represent a substantial portion of the company's overall profits. Additionally, Amazon owns Whole Foods Markets, Twitch, Audible and Ring. While not every acquisition has been a winner, Amazon has added tremendous value to its portfolio over the last 10 to 15 years, and shareholders have greatly profited.

Amazon's common stock has split four times since the company went public in 1997. The first three splits occurred during 15 months in 1998 and 1999. After 1999, Amazon went more than 20 years without a stock split. The fourth and final stock split occurred in June 2022; the company split shares 20-1 instead of 2-1 or 3-1 like previous splits.

Amazon reached an all-time high of $3,507 in July 2021, which, adjusted for the June 2022 split, would be $186. If you held Amazon stock since inception and sold at an all-time high, you'd have netted yourself a 54,000% return — not bad for less than three decades of work. Amazon is now one of the largest companies in the world and should be considered a blue-chip firm, but blue-chip status means that meteoric 54,000% returns are unlikely to be repeated in the future.

Reasons Amazon is a Blue-Chip Stock

Amazon is one of the world's largest and most recognizable companies, and you should consider it for blue-chip investing. One knock against Amazon as a blue chip is the lack of dividends. However, a dividend isn't always required for blue-chip recognition. Dividends can play a significant role when investing in older blue chip firms, but Amazon is still less than 30 years old and still retains a large amount of profit for research and development.

Reason 1: Large Market Capitalization

One characteristic that all blue-chip stocks have is a large market cap. The stock market is a machine where investors vote with their money, and companies with large market caps spring up slowly. A large market cap shows that demand for shares is consistently high, and the company has a solid financial base to fall back on. As of this writing, Amazon is one of the three largest U.S. companies in the world by market capitalization.

Reason 2: Industry Leader

Amazon may have started in a dusty garage, but today the name is synonymous with e-commerce. Amazon Prime, the company's upgrade membership service, boasts over 200 million global subscribers. Of those subscribers, over 60% reported shopping on Amazon at least once a month. Amazon Web Services is an industry leader in cloud computing and API services.

Reason 3: Successful Business History

Few companies have raised their profile more over the last 30 years than Amazon. The company consistently beats earnings estimates, and revenue has grown tremendously, especially in the last 10 years. Amazon shareholders have received handsome rewards, and the company continues to expand into new markets and industries (although it remains to be seen how well the company can perform now that its heart and soul, CEO Jeff Bezos, has retired).

Reason 4: Trades on Major Exchanges

Blue-chip companies are large conglomerates with popular stocks, meaning trading on a major exchange is necessary. Amazon trades on the NASDAQ exchange in the United States — it is one of the largest members of the S&P 500.

Reason 5: High Liquidity / Low Volatility

There was a time when Amazon was a volatile growth stock, but the growth story faded a bit as Amazon matured as a company. Shares still carry a higher beta (1.3) than the overall market. Still, Amazon's place in the tech and consumer discretionary sectors makes it inherently more volatile than consumer staples or bank stocks. This low volatility combines with Amazon's ample liquidity to create a blue ship stock worth owning for the long haul.

Why Consider Investing in Blue-Chip Stocks?

Blue chip firms are highly regarded in capital markets. These companies have stood tall in the face of bear markets, recessions or even economic disasters like the 2008 financial crisis. But, of course, a blue-chip investment isn't going to go straight up every day. Plenty of solid companies have gone through extended bear markets, and you can't diversify market risk away just by building a sturdy portfolio of blue chips.

Whether you're searching for blue chips at 52-week lows or buying them based on momentum, an investment in America's largest and most stable companies has almost always produced quality risk-adjusted returns over extended time frames. Plus, investors who wish to still hold equities in retirement can sleep easy at night knowing their capital is invested in blue chips and not volatile startups.

Amazon Has Shed its Growth Label and Entered Blue-Chip Territory

By nearly all standards and classifications, Amazon is a blue-chip stock. Gone are the days of volatile drawdowns and parabolic gains; the stock certainly isn't at risk of dropping 90% anymore, but the 200% and 300% years are probably in the past. Slow and steady may not excite previous shareholders who saw their investment balloon over the last decade, but Amazon is here to stay.

Amazon has a massive market cap, nearly universal brand recognition and the balance sheet strength to remain a force for decades to come. The company might not yet pay a dividend, but this is really the only mark against its blue-chip status. Consider Amazon as you would other tech giants like Apple and Microsoft — even if their stocks are more volatile than blue chips in other industries, they deserve consideration when looking for blue chip stocks to invest in.

FAQs

Is Amazon a blue chip stock? Here are a few frequent thoughts regarding its status in the investment landscape.

Is Amazon a growth or blue-chip stock?

At one time, Amazon was the pinnacle of growth stocks and its returns since inception bear out that fact. However, while Amazon is still expanding and reinvesting profits into the company, it carries more qualities of a blue chip stock than a growth-obsessed volatile startup.

Is Apple a blue chip stock?

Apple is an excellent stock compared to Amazon since they're both considered tech companies founded by virtuoso leaders in Steve Jobs and Jeff Bezos. Apple is the largest stock in the world by market cap and has a recognizable brand found anywhere in the world. And they even pay a dividend! Apple is most certainly a blue-chip stock based on these criteria.

How do you know if a stock is a blue chip?

There's no hard and fast qualification for blue chip status. Instead, blue chips share a few common characteristics like large market caps, liquid shares, strong sales history, brand recognition and little risk of financial burdens or bankruptcy. Blue chip stocks may not offer the same hefty returns as small caps or growth stocks, but the risk factor is toned down significantly, and a portfolio of blue chips is still a stable path to wealth preservation.