Medical supply and logistics company Owens & Minor (NYSE: OMI) missed Wall Street’s revenue expectations in Q1 CY2025, with sales flat year on year at $2.63 billion. On the other hand, the company’s outlook for the full year was close to analysts’ estimates with revenue guided to $11 billion at the midpoint. Its non-GAAP profit of $0.23 per share was 14.5% above analysts’ consensus estimates.

Is now the time to buy Owens & Minor? Find out by accessing our full research report, it’s free.

Owens & Minor (OMI) Q1 CY2025 Highlights:

- Revenue: $2.63 billion vs analyst estimates of $2.67 billion (flat year on year, 1.6% miss)

- Adjusted EPS: $0.23 vs analyst estimates of $0.20 (14.5% beat)

- Adjusted EBITDA: $121.9 million vs analyst estimates of $116.7 million (4.6% margin, 4.4% beat)

- The company reconfirmed its revenue guidance for the full year of $11 billion at the midpoint

- Management reiterated its full-year Adjusted EPS guidance of $1.73 at the midpoint

- EBITDA guidance for the full year is $575 million at the midpoint, in line with analyst expectations

- Operating Margin: 0%, in line with the same quarter last year

- Free Cash Flow was -$90.76 million compared to -$102.4 million in the same quarter last year

- Market Capitalization: $599.5 million

“Across the business we continued to see strong execution and progress towards our near and long-term strategies. Patient Direct delivered mid-single digit top-line growth with strong performance in nearly all therapy categories led by Diabetes and Sleep Supplies. The top-line growth combined with strong operational execution delivered mid-teen expansion in EBITDA for the segment. Our Products & Healthcare Services segment saw top-line growth in our Medical Distribution division, as well as good progress on driving profit improvement initiatives. We remain actively engaged in the sale process of our Products & Healthcare Services segment,” said Edward A. Pesicka, President & Chief Executive Officer of Owens & Minor.

Company Overview

With roots dating back to 1882 and operations spanning approximately 80 countries, Owens & Minor (NYSE: OMI) is a healthcare solutions company that manufactures medical supplies, distributes products to healthcare providers, and delivers medical equipment directly to patients.

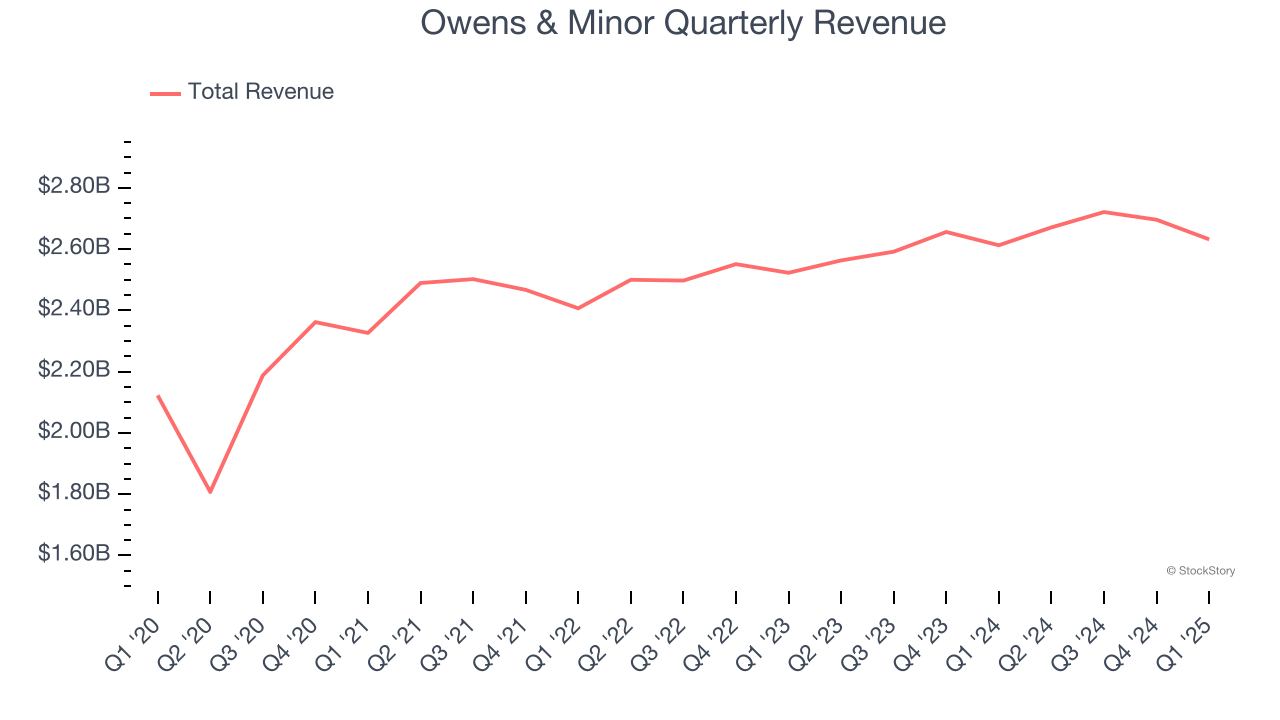

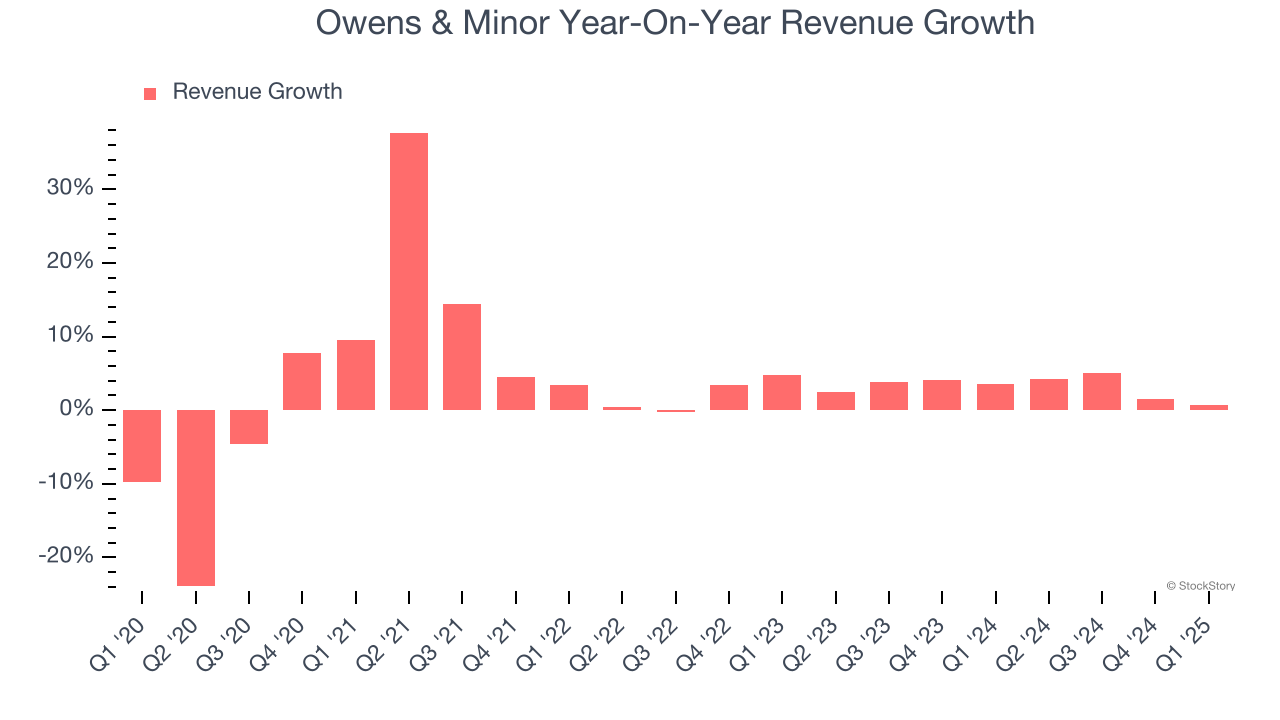

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Owens & Minor grew its sales at a tepid 3.6% compounded annual growth rate. This was below our standard for the healthcare sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Owens & Minor’s annualized revenue growth of 3.2% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

This quarter, Owens & Minor’s $2.63 billion of revenue was flat year on year, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.2% over the next 12 months, similar to its two-year rate. This projection is underwhelming and implies its newer products and services will not catalyze better top-line performance yet.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

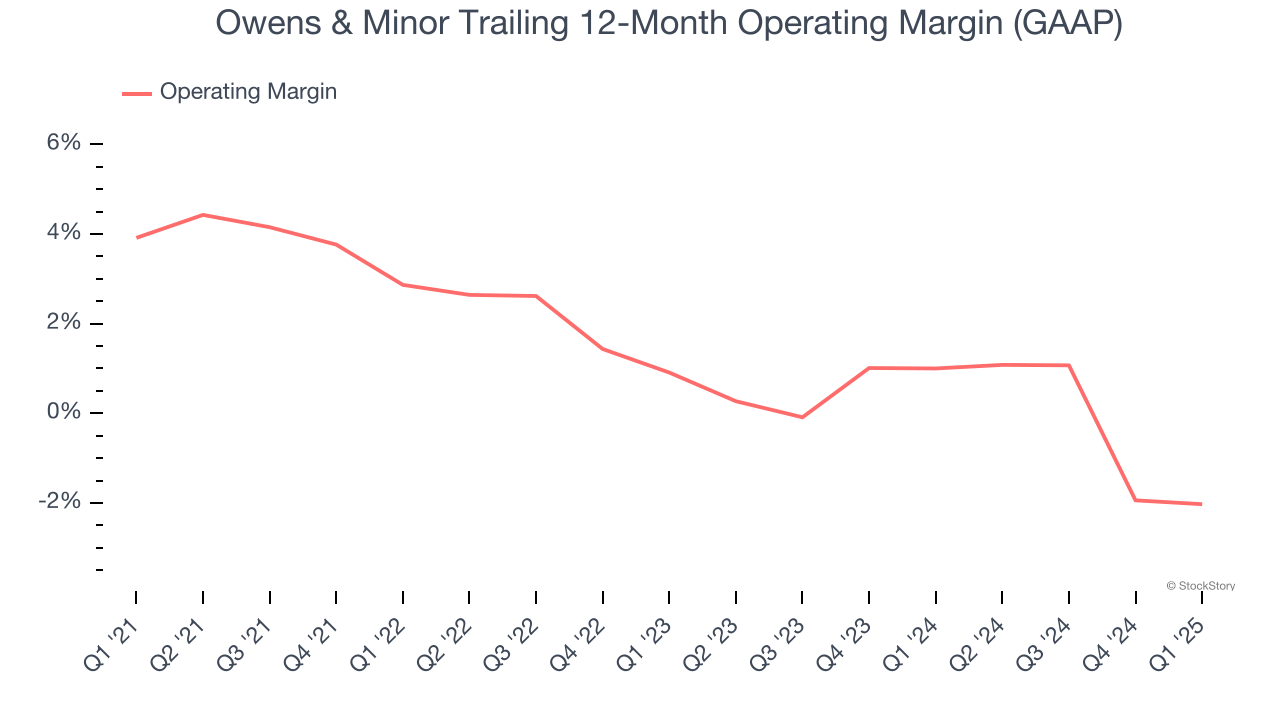

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

Owens & Minor was profitable over the last five years but held back by its large cost base. Its average operating margin of 1.2% was weak for a healthcare business.

Looking at the trend in its profitability, Owens & Minor’s operating margin decreased by 5.9 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 2.9 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Owens & Minor’s breakeven margin was in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

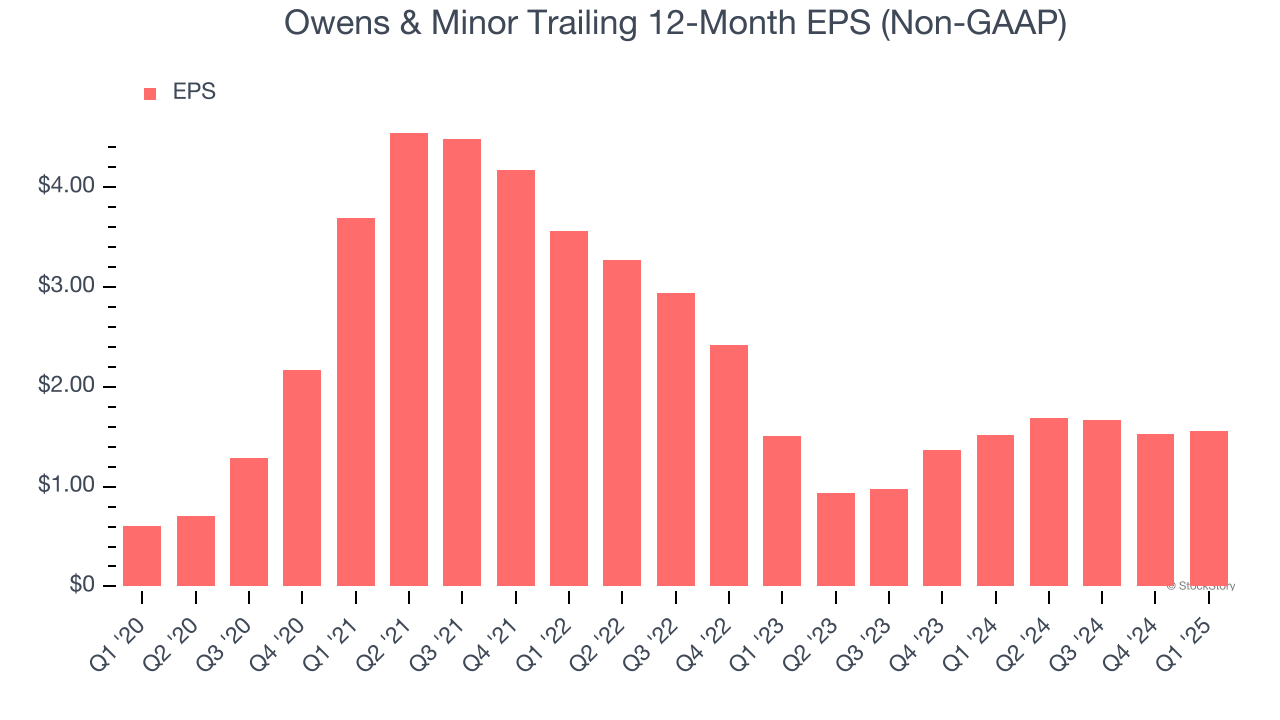

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Owens & Minor’s EPS grew at an astounding 20.7% compounded annual growth rate over the last five years, higher than its 3.6% annualized revenue growth. However, we take this with a grain of salt because its operating margin didn’t expand and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

In Q1, Owens & Minor reported EPS at $0.23, up from $0.19 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Owens & Minor’s full-year EPS of $1.56 to grow 14.9%.

Key Takeaways from Owens & Minor’s Q1 Results

We enjoyed seeing Owens & Minor beat analysts’ EPS expectations this quarter. We were also glad its full-year revenue guidance was in line with Wall Street’s estimates. On the other hand, its revenue missed and its full-year EPS guidance fell slightly short of Wall Street’s estimates. Overall, this was a mixed quarter with something for the bulls and something for the bears. The stock traded up 3.5% to $8 immediately after reporting.

Should you buy the stock or not? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.